When asked to name a favorite childhood snack, most people would like probably name a favorite snack cake—Twinkies, Swiss Rolls, Devil Dogs, Snowballs or another, depending on where they lived. The taste of spongy cake and sweet, creamy filling in the middle still lingers on for some consumers. Nostalgia is a strong force.

Overview | Bread | Tortillas | Sweet Goods | Snack Cakes | Pizza | Desserts | Cookies | Buns & Rolls | Bars | Breakfast Products

Fortunately, many of these items, or new versions of them, are still available at retail. And judging by the number of units sold in the past year—1.7 billion—Americans are glad they are.

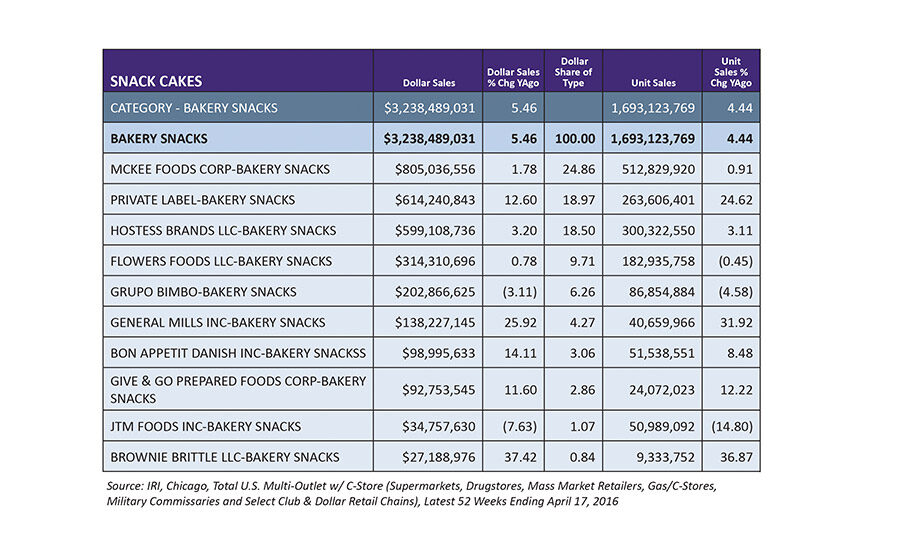

Market data

Data from IRI, Chicago reveals that despite increasing consumer demand for healthier snacks and the availability of more better-for-you snack foods, the overall bakery snacks category recorded sales of $3.2 billion for the 52 weeks ending April 17, 2016—a dollar sales increase of 5.46 percent from the previous year.

Several of the major players in the category saw only marginal increases in dollars sales for the period. Category leader McKee Foods, owner of the Little Debbie and Drake’s brands, recorded an increase in dollar sales of 1.78 percent for $805.0 million. Hostess Brands—maker of Twinkies, HoHos, DingDongs, Zingers and more—saw dollars sales increase 3.20 percent to $599.1 million. Flowers Foods, owner of the Mrs. Freshley’s, Tastykake and Blue Bird brands, saw a dollar sales increase of 0.78 percent to $314.3 million. And Grupo Bimbo, which has Sara Lee Snacks and Entenmann’s in its brands portfolio, saw dollar sales drop 3.11 percent—to $202.9 million—for the 52 weeks ending April 17.

With the exception of General Mills, which saw dollar sales jump 25.92 percent to $138.2 million, and private label, which saw dollar sales increase 12.60 percent to $614.2 million, many of the big winners in the bakery snacks category had dollar sales of less than $100 million for the period. IRI classifies Sheila G. Brownie Brittle from Brownie Brittle LLC as a bakery snack, and that brand saw dollar sales jump 37.4 percent to $27.19 million. Bon Appetit Danish Inc., which produces Danishes, cakes, muffins and other baked goods, recorded a 14.11 percent increase in dollar sales to $98.9 million, while Give & Go Prepared Foods Corp., which also offers a variety of baked goods, was up 11.60 percent to $92.75 million for the 52 weeks ending April 17.

Looking back

Given that most consumers would agree, if asked, that snack cakes are purely indulgent treats, what continues to drive sales in this category?

Those counting calories or trying to reduce their consumption of sweets appreciate that many snack cakes come in single-serve packages or miniature sizes. Single-serve packaging also makes snack cakes portable treats that can be consumed on-the-go or added to lunchboxes and backpacks. Consumers seeking variety can choose from an ever-expanding assortment of products and flavors, including seasonal and/or limited-time offers (LTOs).

“When it comes to snacks, taste is king,” says Ellen Copaken, vice president of marketing, Hostess Brands LLC, Kansas City, MO. “Great-tasting, indulgent flavors and product forms continue to drive strong velocity. There is, of course, lots of discussion about health-and-wellness, whether it’s portion control, positive nutrition or other ways to deliver permissible indulgence. But we haven’t seen too many examples of that yet in the snack cake category.”

Still, Copaken notes that Hostess Brands recently reformulated its Mini Muffins to have better taste and nutrition (8 grams of whole grains per serving) with no artificial colors, no high-fructose corn syrup and real fruit or chocolate. “We know that as much as consumers want healthy choices, they won’t trade-off for taste,” she says. “Brands need to deliver both.”

Some of Hostess’ introductions over the past year included LTOs: Peppermint Ho Hos for Christmas and Chocolate Covered Strawberry CupCakes and Dark Chocolate Raspberry CupCakes for Valentine’s Day. The company also brought back one of its most iconic and popular products—the Suzy Q. “Hundreds of consumers have requested we bring this product back to the market, and we are thrilled we were finally able grant their wishes,” says Copaken.

Other new products from Hostess include M&M’s Brownies and Milky Way Brownies, each topped with Mars candy. “We kicked off a strategic partnership with Mars and are developing other premium flavor varieties for the future,” says Copaken. “Our new Brownies sales performance has been spectacular since the launch two months ago.”

Consumers with allergies or food sensitivities are also finding it easier nowadays to enjoy a sweet treat. “A small, but rapidly growing, niche within the snack cake category is the allergy-friendly segment,” says Doon Wintz, president, Wholly Wholesome, Chester, NJ. This category, he explains, features products made in an environment free from two or more of the most-common allergens, including gluten, tree nuts, peanuts, dairy, soy, eggs, fish and shell fish.

“The rise in the allergy-friendly segment speaks to consumers’ need for transparency,” Wintz says. “A trend itself, transparency is no longer a luxury. Shoppers demand it, and their buying behavior proves their commitment to supporting companies that align with their values. Looking up and down the aisles of the grocery store, shoppers are inspired to ask smarter questions about everything from the manufacturing process to the sourcing of ingredients. Allergy-friendly foods make it easier than ever to differentiate one snack cake from the next.”

Wintz contends that this move toward cleaning up the category has helped to move snack cakes forward: “In the dessert category as a whole, more and more consumers have come to the conclusion that ingredients are just as important as the nutritional panel when considering food choices. The move from artificial ingredients and to unprocessed ones continues to gain momentum. Today, preservatives are not likely to make their way into the shopping carts of today’s most in-tune consumers.”

Wholly Wholesome offers ingredient-conscious consumers a variety of natural and organic snack cakes, such as its Crumblettes, available in Cinnamon and Pumpkin.

Otis Spunkmeyer, Los Angeles, an ARZYTA brand, recently entered the retail snack cakes category with multiple products lines that contain “No Funky Stuff”—no artificial flavors or colors, high-fructose corn syrup or partially hydrogenated oils. The line includes a variety of clean-label snack cakes, such as Crème Cakes with sweet vanilla or chocolate-caramel crème and Frosted Crème Cakes, golden snack cakes filled with sweet cream and topped with a layer of vanilla or strawberry icing.

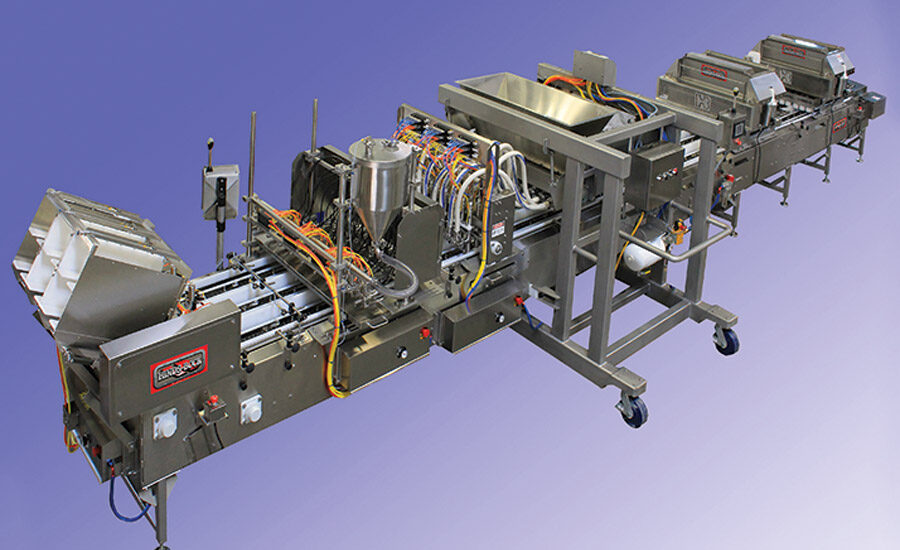

Creating enough snack cakes to satiate millions of consumers can prove challenging. “Turn-key, high-speed lines that produce thousands of pieces per hour, but require minimal labor, are quickly becoming the largest sector of custom capital expenditure and focused-machine quotation requests,” says Mark Young, senior sales executive, key accounts, market development, Hinds-Bock Corp., Bothell, WA.

Young notes that some of the equipment leaders in this segment are highly automated, but flexible, snack cake, dessert and portion-control-sized depositing systems capable of carrying three to four different pan and tray profiles. These systems often include adjustable tray denesters, pan or tray spray oiling systems, multiple-piston batter depositors with adjustable centerline tooling and various topping applicators.

Hinds-Bock’s recently introduced Mini Snack Cake production line allows for running various pan configurations at a high volume of production. According to Young, the 30-foot-long conveyor contains multiple modules that can be part of the recipe or bypassed, if not a part of the recipe. “This highly flexible system can typically be run with two laborers,” he says. “When the throughput of finished production is scaled against the labor costs of operation, this system realizes an amazingly quick investment payback schedule.”

Looking forward

The snack cake category, perhaps more than other baked goods categories, still has room for improvement when it comes to better-for-you ingredients and nutrition.

“Elevating America’s favorite desserts by utilizing clean ingredients and a transparent manufacturing process is a great way to leverage their love for signature treats like snack cakes,” says Wintz. Free-from snack cakes also have room to grow. “As the allergy-friendly community grows, so will their desire for the food they grew up with. Whether it’s nostalgic or a simple desire for a clean indulgence, shoppers will be able to satisfy their cravings with familiar flavors.”

Improvements to ingredients and other clean-label moves could help bring a premium sheen to snack cakes. “I think there is opportunity to bring much more excitement and innovation to this category,” says Copaken. “There is also an opportunity to provide more options for consumers, including cleaner labels and more-nutritious choices. There is opportunity to bring more premium products and flavors to the snack cake aisle.”

Overview | Bread | Tortillas | Sweet Goods | Snack Cakes | Pizza | Desserts | Cookies | Buns & Rolls | Bars | Breakfast Products