Confectionery retail volume sales in Vietnam are projected to rise by 7 percent in 2012, with retail value sales totaling $298 million. Higher purchase power is helping drive the consumption of chocolate among middle-class consumers, especially in Vietnam’s largest cities.

Real GDP should grow by 5.6 percent in 2012. The economy is hindered by a slump in exports as well as the high cost of finance and availability of working capital. Real GDP grew by 4 percent at an annualized rate during the first quarter of 2012. This represents the slowest rate of growth since 2009.

Economic growth averaging about 7 percent over the past decade has helped Vietnam reach what the World Bank calls lower middle-income status. However, the economy slowed in 2009. The slump was due to weakening exports, a slump in construction and a steep decline in the property market.

To reignite the economy, the government boosted public spending significantly. The support went mainly to exporters and small- and medium-sized enterprises. As a result, real GDP rose by 6.9 percent in 2010. However, one consequence of all this spending was a rapid rise in inflation. Policy makers were ultimately forced to adopt a package of monetary and fiscal tightening measures that were maintained throughout 2011. These policies dampened the economy and real GDP slowed again – this time to 5.9 percent.

|

Trading environment

Foreign trade has been the main driver of economic growth for at least a decade. In 2011, exports accounted for 77 percent of GDP, up from 68.8 percent in 2008. Exports (in dollars) grew by 32.3 percent in 2011.

Mineral fuels accounted for 17.9 percent of all exports in 2011, while exports of miscellaneous manufactures made up 32.8 percent. Vietnam's export markets are rather diverse with the United States accounting for 19.1 percent while the EU and Japan comprised 18.3 percent and 12.0 percent respectively in 2011.

Trade with mainland China was boosted by a free-trade agreement between the Association of Southeast Asian Nations and Beijing, which took effect in January 2010. In 2012, Vietnam should complete negotiations for the Trans-Pacific Partnership (TPP) and free trade agreements (FTA) with South Korea and the EU.

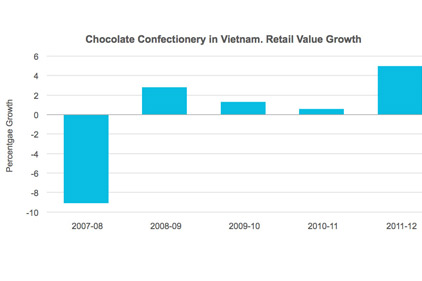

Chocolate confectionery

Previously, chocolate confectionery products were usually considered a luxury locally. Vietnamese consumers purchased chocolate confections as a gift on special occasions, such as Valentine’s Day or Lunar New Year holidays. Over the review period, chocolate confectionery has become more and more popular among Vietnamese consumers. The increasing average household income, together with the influence of Western culture on consumers’ lifestyles, created a good opportunity for the strong growth of chocolate confectionery in Vietnam. Consumers started to buy chocolate confections as a daily snack. As a result, local manufacturers have tried to improve their production technology to manufacture chocolate products that have a lower price but still good quality in order to satisfy increasing local demand. Projections place chocolate confectionery growth at 5 percent.

Bagged self-lines/soft-lines will register the fastest volume growth rate (+10 percent) within the chocolate category in 2012. Vietnamese consumers increasingly consume chocolate confections as snacks and sometimes they only need to have a small portion each time. Therefore, consumers choose bagged self-lines/soft-lines thanks to this format’s flexibility, convenience and share-ability.

Standard boxed assortments are more frequently purchased as gifts by the Vietnamese. Thus, domestic manufacturers paid more attention to improving packaging designs for standard boxed assortments compared to other categories. Most of the designs reflected premium and elegant elements, critical characteristics Vietnamese consumers look for when they purchase chocolate confectionery products. Standard boxed assortments are projected to grow by 7 percent in retail volume in 2012.

|

Sugar confectionery

Sugar confectionery in 2012 is expected to decline 1 percent in retail value (constant terms) and rise by 7 percent in retail volume units.

Last year Vietnamese consumers saw a wider range of sugar confectionery products in terms of flavors, types and brands. Low-income consumers could choose local products that have acceptable quality at a lower price. Middle-income and high-income consumers can purchase international products that have delicious tastes and superior quality.

In recent years, local manufacturers have tried to enhance their technology to produce high quality products. The move aims at not only changing Vietnamese consumers’ perception of local products, but also better positions local confectioners to compete with foreign products.

The medicated confectionery sector will enjoy strong retail volume growth (+7 percent) in 2012 as the Vietnamese had higher chances of having a cough due to the country’s increasingly polluted environment. Vietnamese perceive medicated confectionery items as a medical self-treatment. Therefore, they traditionally purchase these products at pharmacies or drugstores.

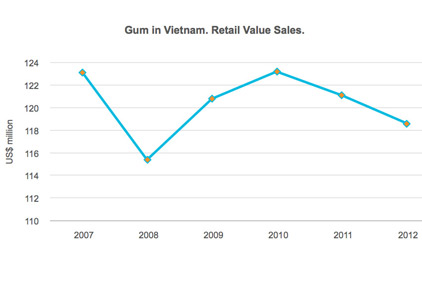

Gum

Gum was projected to decline by 2 percent in retail value (constant terms) and rise by 6 percent in retail volume units last year.

Sugar-free gum will continue to experience the highest retail value growth rate (+12 percent in constant terms) in 2012, thanks to the increasing awareness of personal appearance and hygiene in Vietnam. Together with continuous advertising and marketing campaigns from the leading players, such as Lotte Vietnam, sugar-free gum will continue to expand strongly with different brands, pack sizes and flavors. In 2012, xylitol gum will be the most popular functional gum.

For further insight, please contact Francisco Redruello, Euromonitor International's Senior Foods Analyst, at francisco.redruello@euromonitor.com.