Packaging with a feminine mystique, beverage industry-inspired flavors, “contemporized” brand campaigns and “noncommittal” snacking options — those are just some of the new gourmet chocolate and confectionery trends spotted at this year’s 59th Summer Fancy Food Show, North America’s largest specialty food and beverage exposition.

Hosted by the Specialty Food Association (SFA), the show was held June 30 to July 2 in New York’s City’s recently upgraded Javits Convention Center. With an estimated 24,000 attendees exploring the 2,500 domestic and international exhibitors displaying more than 180,000 specialty food products, the show broke attendance and exhibit space records.

“New York is the birthplace of the Fancy Food Show and its home. Our return to the city coincided with unprecedented interest in specialty food and the passionate entrepreneurs who create it,” says Ann Daw, president of the Specialty Food Association, the show’s owner. “With the record showing, all indications point to another strong year for our industry.”

Daw’s bullish outlook follows last year’s record growth. According to the SFA’s State of the Specialty Food Industry 2013 report, total U.S. sales of specialty foods in 2012 vaulted up 14.3 percent, or more than double the prior year’s growth of 6.8 percent. In the candy and individual snack product category, total retail sales in specialty food markets grew 12. 2 percent to $1.145 billion between 2010 and 2012, 4.1 percent more than overall food market sales.

Glancing over the list of silver and gold SOFI (Specialty Outstanding Food Innovation) awards, it was gratifying to note that chocolate and confectionery products placed in almost all applicable categories: Food Gift, Innovation in Packaging Design or Function, and New Product. The USDA Certified Organic Product was the only category that failed to garner an award. This triumph illustrates both the creativity of the chocolatiers and confectioners as well as demand from consumers who recognize quality on par with their European counterparts.

The creativity in packaging design was delightful, especially when appealing to women. Seattle Chocolate Co.’s new Jcoco line uses soft touch vellum-like paper that is very Mad Men sensual. The purse-shaped packaging opens to reveal three 1-oz. Bars sporting iconic 1960s black-and-white images. Torie & Howard adapted the gift handbag shape to hold an assortment of its organic hard candies. Both products received silver SOFIs.

Flavor mapping of SOFI chocolate and confectionery winning products didn’t reveal any specific trend, but rather that the makers were exploring all points of the palate compass. Flavor ports-ofcall included citrusy (e.g., Chocolate Moderne’s Blood Orange Bergamot dark chocolate bar and Torie & Howard’s Pink Grapefruit & Tupelo Honey hard candies; bold (e.g., Olive & Sinclair Chocolate Co.’s Mexican Style Cinnamon Chili and CocoaPlanet’s CocoaMint hot chocolate); just plain different (e.g., Dolfin’s Milk Chocolate with Apricot from Morocco and The Tea Room’s Chamomile & Honey Organic White Chocolate Bar); as well as beverage-influenced flavors.

For example, society’s thirst for coffee has inspired chocolate and confectionery makers to amp up their flavor assortments with espresso. Some Examples debuting at the show included John Kelly Chocolate’s Dark Chocolate Espresso Truffle Fudge Bars, Droga Confection’s NYC Double Chocolate Espresso Salted Caramels, Cacao Atlanta’s Domino Bar Bomba Espresso and Enstrom’s Candies’ Dark Chocolate Espresso Toffee.

The coconut water tsunami has been spilling over to the confectionary aisle as well, bumping up the sales of Madécasse’s Toasted Coconut Dark Chocolate Bar and interest in Seattle Chocolate Co.’s jcoco brand Vanuatu Coconut Pecan Origin Milk Chocolate Bar.

Two other new product concepts worth noting include items from Ripple Brand Collective and the Sticky Toffee Pudding Co. Ripple Brand displayed its barkThins, pieces of thin chocolate bark served in a gusseted pouch, which should open up a new eating opportunity, akin to what Shelia G’s Brownie Brittle has done with baked desserts. Sticky Toffee took a traditional British dessert, sticky toffee pudding, and converted it into a scrumptious confection; think Downton Abbey meets American candy bar.

In other news, over the past year, two gourmet chocolate industry stalwarts, Harbor Sweets and Seattle Chocolate Co., have been busy “contemporizing” — in the words of a Harbor Sweets’ press release — their product offerings.

Harbor Sweets’ new line, developed with cookbook author Lora Brody, is called Salt & Ayre. Seattle’s new line is jcoco, taking the “j” from founder Jean Thompson and the “coco” as in chocolate, but also as a nod to the fashion pioneer, Coco Chanel, in creating a new brand of American couture chocolate, says Brand Manager Katie Geer.

Here’s a quick run-down of SOFI award-winning confectionery and chocolate products as well as some nonwinners of note.

1. Chocolat Moderne

|

Chocolat Moderne’s Joan Coukos continued her winning streak, garnering the second gold SOFI award in a row in the chocolate category. Her winning creation was a dark chocolate bar filled With caramel, flavored with fresh blood orange juice and a twist of bergamot oil. The bar is part of Chocolat Moderne’s Avant-Garde bar line, so named as the bars are splattered with naturally colored cocoa butter “paint” in the style of modernist painter Jackson Pollack. According to Coukos, the choice of citrus ingredients was inspired by her Greek heritage where candied citrus rind was often served at holidays. The 3-oz. (85 g) Blood Orange Bergamot Dark Chocolate Bar retails for $8.00.

During the last several years, the Manhattan-based chocolate maker has produced an impressive stream of creative and well-crafted confections. For example, debuting at the show were two caramelfilled milk chocolate bars, one flavored with pumpkin and ginger and the other with smoky mescal and coarse grains of sea salt. Coukos also showed off her new assortment for the fall holiday season, Kindred Spirits, a Valrhona couverture bonbon line with liquor-laced ganaches. The line includes white chocolate paired with Plymouth Gin, blond chocolate with Del Maguey Mescal, milk chocolate with Tuthilltown Spirits’ Hudson Baby Bourbon Whiskey and dark chocolate with Bowmore single-malt Scotch.

Coukos is getting noticed. This year, she was included as one of 10 small business owners featured in the SFA’s first ever branding campaign. WE Network’s Preston Bailey’s Midnight Wedding used a thousand pieces of her chocolate to construct a chocolate tree. She has also Sticky Toffee Pudding Co.

2. Sticky Toffee Pudding Co.

|

The winner of the gold SOFI award in the confectionery category went to the Sticky Toffee Pudding Co. For its Chocolate Tiffin Bar. Since 2002, Founder Tracy Claros has been recreating those traditional British puddings she remembered from her English Lake District childhood and adapting them, with a twist, for the American dessert market. This is the Austin-based company’s fourth gold SOFI, although the first in the confectionery category.

The Chocolate Tiffin Bar is part of a new line of British confectionery bar products the company introduced at the show. The other two products are the Millionaire’s Shortbread and Toffee Flapjack.

“When developing this line, I was looking for each product to have delicious, balanced flavors and complex texture with crunch and chewiness,” explained Claros. The Chocolate Tiffin Bar includes a dark chocolate (61 percent), pieces of crunchy cracker, roasted almonds, glace cherries and raisins. The 2-oz. (60 g) bar retails for $3.99.

Considered a “classic” British dessert, the traditional sticky toffee pudding is a steamed and very moist sponge cake, covered with toffee sauce and served with either vanilla custard or vanilla ice cream. The pudding is served in cafés in the Lake District as an accompaniment to a cup of tea or a sweet treat after eating a sandwich for lunch.

Americans will appreciate the Chocolate Tiffin Bar’s provenance, texture and vivid chocolaty taste. Mass market candy bars, in contrast, will seem highly processed and over sugared.

3. Dolfin Chocolate/ Belgium’s Chocolate Source

|

Dolfin won a silver SOFI in the chocolate category. This Brusselsbased chocolate maker has made an international reputation by blending its premium chocolate with fruits, spices, herbs and flowers to produce elegant, but uncomplicated bars, says the company’s Export Director Adrien Boels. The family-owned company is also proud to be certified CO2 neutral.

The winning bar was the Milk Chocolate with Apricots from Morocco, part of a recently reformulated and redesigned product line called Carnetdu Voyage Or travel notebook. The eight-product line offers consumers a sense of global taste travel by flavoring each bar with a distinctive ingredient and decorating the label with beautiful textile designs from the featured country. The 1-oz.(30 g) bars retail for $1.70.

Boels adds that one of the side benefits of competing in the SOFI competition involves receiving copies of the judges’ comments, which chocolate makers will use to help improve their product line, taste, quality and visual appeal.

4. The Tea Room Chocolate Co.

|

Six years after establishing a tea salon, owner Heinz Rimann decided to expand by pairing his tea with chocolate. His first products were teainfused truffles, followed by bars. The San Leandro, Calif.-based company’s Chamomile & Honey Organic White Chocolate Bar received a silver SOFI in the chocolate category, its second SOFI award. Coincidently, herbs tied with spirits as the most popular chocolate Flavor in the SFA’s flavor trend survey. The 1.8-oz (50 g) bar retails for $2.99.

In addition to the silver SOFI award, The Tea Room has received other prestigious awards during the past two years. These include the Tokyo Foodex Grand Prix 2013 (the only U.S. company to receive an award), International Chocolate Competition America Segment finalist award 2013, Paris SIAL Innovation Award 2012, and the International Chocolate Salon Grand Master Award 2012.

5. Tonewood Maple Co.

|

Tonewood Maple Co.’s Tonewood Maple Wafers garnered one of the three silver SOFI winners in the confectionery category. Canadian by birth and herself a hobby maple syrup maker, Dori Ross has maple syrup in her veins. By adapting her marketing skills honed for years working at Gillette, she is determined to showcase the versatility of maple syrup. “What I am trying to do is to show people that maple can go beyond the big jug used for pancakes and waffles; there are so many other uses that take it beyond a breakfast-only item,” says Ross.

Such uses exhibited at the show included the above mentioned Maple Wafers, eight maple wafers attractively packaged in gift boxes. The wafers are becoming popular as accompaniments to a cup of tea, for gift baskets and as hotel in-room amenities. The 3-oz. (85 g) box retails for $16.99.

The one- year-old Waitsfield, Vt.-based company sources all of its syrup from its neighbors, some being fifth- and sixth-generation sugar maple farmers. To show its support for its small-scale suppliers, Tonewood offers a maple tree adoption program to help preserve the tradition of sugar maple farming. Contributors, in return, receive a certificate, a photo of their tree, Tonewood’s Four Grade syrup collection and Sweet Pairings (including a maple cube and eight maple wafers). As a “One Percent for the Planet” member, Tonewood donates a percentage of all sales to support climate change research at the University of Vermont’s Proctor Maple Research Center.

6. Big Picture Farm

|

In the New Product category, Big Picture Farm won a silver SOFI for its Cocoa Latte Goat Milk Caramel made with goat’s milk, Askinosie white chocolate (also made with goat’s milk) and Mocha Joe’s (a local coffee roaster) espresso. This award follows the Townshend, Vt.-based caramel maker’s 2012 gold SOFI in the confectionery category; very impressive for a young company with thirty-something owners.

Has success affected the farm’s operations? Co-owner Lucas Farrell confessed that the company’s herd of 40 goats has become a bit more spoiled and that production has accelerated to keep up with the orders. But then they hope to reach a plateau of sustainability and “hang out there for a while.” A 3.2-oz.(90 g) box consisting of about 12 or 13 pieces of caramel retails for about $10.

7. Seattle Chocolate Co.

|

The Seattle Chocolate Co. Received a silver SOFI in the Innovation in Packaging Design or Function category for its new jcoco Vanuatu Origin Milk Chocolate Bar.

The bar’s packaging is purse-shaped and constructed of soft touch vellum-like paper of saturated turquoise color and copper embossed foil. Inside are three 1-oz. Bars whose graphics feature iconic 1960s black-and-white images from the Getty image collection. The three-bar concept is designed to offer portion control, allowing consumers to eat or share a bar and then put the rest back in the purse. The jcoco line consists of seven flavors: the Vanuatu Origin Milk Chocolate Bar mentioned above, which will be reformulated with coconut and pecan inclusions, plus Cayenne Veracruz Orange, Jingle Berry, Edamame Sea Salt, Black Fig Pistachio, Noble Dark with Cocoa Nibs and Agave Quinoa Sesame. The 3-oz. (85 g) purse retails for $8.00.

8. Torie & Howard

|

SOFI finalist in the Food Gift category was Torie & Howard’s Organic Hard Candy Gift Handbag, a cute gift handbag with a grosgrain ribbon strap. Inside is a drop-in cellophane bag holding assorted flavors of the company’s hard candy. Each hard candy has a dual-flavored profile, such as d’anjou pear & cinnamon or blood orange & honey, all using natural flavors and sweetened with organic sugar and organic brown rice syrup.

“Our core demographic is women from 18 to 55, mothers, college educated; health conscience and [who]wants quality with value. But we also have a quite a few men purchasing these products As gifts,” says co-owner Torie Burke. The New Milford, Conn. Company has been racking up awards: NCA Sweets & Snacks Expo Premium/Gourmet category finalist 2012, NY Coffee Fest Best New Consumables Product winner 2012 and Kosher Fest Best New Confectionery Product winner 2012. Each 6-oz. (170 g) handbag retails for $6.99 to $8.99.

Amongst the non-SOFI award winners, the following debuted with some exciting new confectionery products or concepts.

9. Ripple Brand Collective

|

If you like indulgent but portion constrained brownie brittle or brownie crunch, then the new snacking chocolate equivalent is barkThins by Ripple Brand Collective based in Congers, NY.

As the name implies, barkThins are pieces of thin chocolate bark stored in a gusseted resealable bag. Consumers simply reach in, break off the amount they want and then close up the bag. That eliminates carefully rewrapping any bar remnants. “It’s great for non-committal snacking, meaning you choose how much chocolate you want to eat or share,” explained Chief Marketing Officer Deborah Holt.

Debuted at the show, Holt anticipates merchandising the product in shipper displays in multiple store locations, such as the snack, candy and checkout Aisles. Four flavors (all Fair Trade certified) are available: Dark Chocolate Pretzel, Dark Chocolate Mint, Milk Chocolate Peanut and Dark Chocolate Almond. A 4.7-oz. (133 g) bag retails for $4.49-4.99.

10. Chocomize

|

Another innovative take on chocolate bark exhibited at the show was Chocomize of Long Island City, N.Y. While customizing chocolate bark with “thank you” or “I love you” notes isn’t new, what Chocomize has excelled in is adept marketing of the chocolate personalization concept on the Internet. Most traditional chocolate companies tend to focus on the retail walk-in trade, neglecting potential opportunities available with Internet commerce.

“The challenge is to come up with a product that engages the online customer; and provide a product which is very sexy for them that they would like to try,” says Founder & CEO Fabian Kaempfer. Chocomize’s corporate gifting line includes such customers as Buick, Google, Nordstrom and Cheerios. In November, the company was selected as one of FaceBook Gift’s first vendors. To order, customers select the chocolate type (e.g., dark), up to five Ingredients and label/logo insertion. The average retail price for a 3.5-oz. (100 g) bar is $6.50.

11. TCHO

|

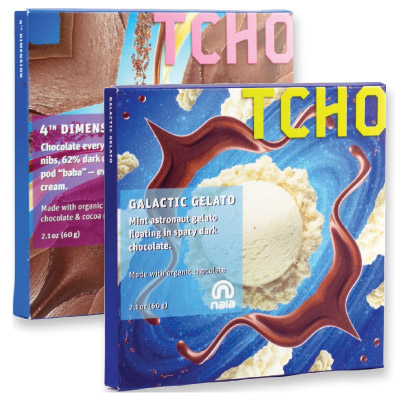

TCHO discovers inclusions! The bean-to-bar maker has earned an excellent reputation for crafting top quality origin bars. For example, the company collected four finalist awards in the Americas segment of the 2013 International Chocolate Competition. Then, realizing that an estimated 80 percent of bars sold in supermarkets have inclusions, TCHO’s chocolate mixologist Brad Kintzer decided to follow that trend, but with a playful, premium spin as well as a dash of hometown San Francisco pizzazz.

Its inclusion bar line contains seven products, each with eye-catching funky packaging graphics designed by the original creative director of Wired Magazine, John Plunkett. These include: Mason Dixon (a dark milk chocolate bar that hitches Yankee-grown maple sugar with nibs soaked for a month in bourbon from Kentucky-based Woodford Reserve); Strawberry Rhubarb Pie (a great American classic dessert combination incorporating freezedried pieces of fruit with a specially formulated pie crust); 4th Dimension (a four-way chocolate bar, including dark chocolate, plus nibs, freeze-dried chocolate ice cream and dried pulp Sometimes called “baba” — from the cocoa pod, which adds a crisp clean flavor); Galactic Gelato (mint gelato from San Francisco Bay area gelato maker, Naia, then freeze-dried like the astronaut ice cream one finds at the Smithsonian’s Air & Space Museum); Wild & Nutty (a classic twist on the fruit and nut bar); and Tchunky TCHOtella (it’s a gianduja take on Nutella). The 2-oz.(60 g) bars retail for $6.95.

12. Chuao Chocolatier

|

Always a flavor trendsetter, Chuao’s Co-founder, President and Master Chocolatier Michael Antonorsi has been inspired by popular American salty-sweet combinations of familiar ingredients. Last year, his San Diegobased company released the Potato Chip Bar. This year, he created the Pop Corn Pop Bar following Americans’ love affair with popcorn.

“I was playing with ways to use popcorn in a chocolate bar, when I realized how much more fun it would be to simulate popcorn popping in the bar,” said Chef Antonorsi. An added twist is that the bar doesn’t use popcorn, but puffed amaranth, plus milk chocolate (41 percent), toasted corn chips, popping candy and sea salt. “First, you get the sensation of melting chocolate, then the pop-pop-pop of popping rocks; and when that slows down, you are left with little grains of popped amaranth. It is very entertaining.” Because the Pop Corn Pop Bar doesn’t contain spices, it provides a more kid-friendly popping candy alternative to Chuao’s hot chipotle-spiked Firecracker Bar. The 2.8 oz. (80 g) bar retails for $6.00.

13. Madécasse

Madécasse showcased its newest bar, the 70 percent Toasted Coconut Bar with crunchy coconut shreds. Following the Madagascar-based company’s mission, all the bar’s ingredients are sourced in Madagascar. “The great response to this new bar has, in some part, been influenced by spill-over demand from the coconut water market,” reported Marketing Director Joe Salvatore.

Founded in 2008 by two Peace Corps volunteers stationed in Madagascar, Madécasse is a bean-to-bar chocolate maker. Last November, the company received the Foundation for Social Change’s Leader of Change 2012 award. The award, given to corporations and individuals that have a proven business capacity for solving environmental problems, exemplifies innovation and leadership skills. The retail price for a 2.6-oz. (75 g) bar is $5.99.