>For a full list of how confectionery industry events are being impacted by the coronavirus, click here.

Nielsen has released data on the six stages of consumer behavior shoppers are going through during the coronavirus (COVID-19) pandemic. While the first three stages listed below offer insight into what’s already started to happen, Nielsen also has released predictions for the final three.

The major takeaway? Online shopping will be hugely impacted by this and will likely grow in popularity.

Nielsen’s Global Intelligence leader Scott McKenzie said the spending patterns identified across the various thresholds will be critical to understand as stores work to maintain supply levels of in-demand items.

“The outbreak has already caused an array of changes in shopping behavior, and we’re focused on understanding the ones that will come next, how long they’ll last — and whether any will stay with us after the outbreak is behind us.” McKenzie said.

Read on to gain insight into the six stages of consumer shopping during COVID-19.

1. Proactive health-minded buying

COVID-19 event markers:

Minimal localized cases of COVID-19 generally linked to an arrival from another infected country.

How consumer behavior shifts:

Interest rises in products that support overall maintenance of health and wellness

2. Reactive health management

COVID-19 event markers:

First local transmission with no link to another location and first COVID-19 related death/s

How consumer behavior shifts:

Prioritize products essential to virus containment, health and public safety, e.g. face masks.

3. Pantry preparation

COVID-19 event markers:

Multiple cases of local transmission and multiple deaths linked to COVID-19.

How consumer behavior shifts:

Pantry stockpiling of shelf-stable foods and a broader assortment of health-safety products; spike in store visits; growing basket sizes.

4. Quarantined living preparation

COVID-19 event markers:

Localized COVID-19 emergency actions. Percentage of people diagnosed continues to increase.

How consumer behavior shifts:

Increased online shopping, a decline in store visits, rising out-of-stock, strains on the supply chain

Prediction:

Online shopping infrastructure will be put to the test.

Early indicators:

In Italy, consumers grew heavily reliant on online shopping and fulfillment (while significantly reducing in-store visits) to meet their health and household needs. This will challenge areas where fulfillment infrastructure cannot keep up with demand.

5. Restricted Living

COVID-19 event markers:

Mass cases of COVID-19. Communities ordered into lock down.

How consumer behavior shifts:

Severely restricted shopping trips, online fullfillment is limited, price concerns rise as limited stock availability impacts pricing in some cases

Prediction:

Supply chain challenges will drive consumers to be less price sensitive on high demand packaged goods or those that guarantee hygiene standards.

Early indicators:

China experiences severely restricted shopping trips and online fulfillment challenges at this stage. And price hikes on in-demand products will occur in some countries, but not all. We expect these factors will drive increased basket size in other markets and in some cases, influence consumer willingness to spend more on hygiene needs and healthful food products.

6. Living a new normal

COVID-19 event markers:

COVID-19 quarantines lift beyond the region/country's most-affected hot spots and life starts to return to normal.

How consumer behavior shifts:

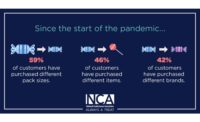

People return to daily routines (work, school, etc.) but operate with a renewed cautiousness about health. Permanent shifts in supply chain, the use of e-commerce and hygiene practices.

Predictions

Crisis-buying patterns during the outbreak will spread adoption of new, permanent behavior changes.

Early indicators:

New health and safety labeling may be critical in winning over cautious consumers, based on changes made in China, particularly in home delivery products. Older generations are turning to online shopping to meet more of their household needs.