“A small hobby turned into a Clarendon Hills-based candy company and a sugar-fueled international obsession,” reads the lead sentence in a recent Chicago Tribune article about Vintage Confections, a Chicagoland custom lollipop company. It’s a classic small entrepreneur start-up story with one major twist: thanks to the internet, this boutique candy company is doing an enormous amount of business in China.

According to the article, “Vintage Confections says 95 percent of its business is online and that, according to IP and mailing addresses and customer feedback, 95 percent of those customers are Asian. Half live overseas, mostly in China.”

Unusual? No doubt. Improbable? No longer. Moreover, this sweet vignette helps illustrate the global state of the industry for confections: borders are breaking down. If Vintage Confections can sell hi-end lollipops for $40 in China, it’s clear that ingenuity and innovation can propel confectionery sales anywhere in the world.

In essence, this year’s annual overview on global confectionery sales reinforces the ongoing discussion about emerging markets. It also reveals the need to re-examine mature markets that still hold plenty of opportunity and growth, albeit to those who can transform a mere lollipop into a luxury accessory.

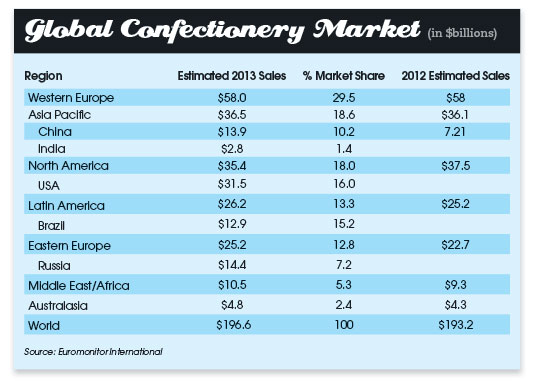

A quick glance at the numbers within the Global Confectionery Market chart reveals flat growth in Western Europe, drop-offs in North America and even Asia Pacific, but strong upticks in Latin America, Eastern Europe, the Middle East Africa and Australasia. New in this year’s chart is the isolation of specific country markets within regions, such as the United States, China, India, Brazil and Russia — all key confectionery markets.

The size and impact of these single-country markets cannot be overemphasized, be it for Mars, Mondelez International, The Hershey Co., Nestle, Ferrero or say even a Vintage Confections. Earlier this year, Hershey announced that its Hershey’s Kisses chocolates had surpassed $100 million in annual sales in China, making it the first Hershey Co. brand to reach this milestone in a country outside of the United States.

“Kisses chocolates have become an iconic product for Chinese consumers,” asserted Max Rangel, senior v.p. of the Chocolate Strategic Business Unit at Hershey, earlier this year. “What started as ‘little Hershey’s Kisses with a big chocolate taste’ has evolved into a favorite product to share and for gifts for the most important occasions, such as weddings and special holidays.”

|

In just five years, Hershey’s Kisses brand sales in China have grown 20-fold, reflecting the dramatic growth of the country’s confectionery market.

By 2016, China is forecasted to be the No. 5 confectionery market in the world with more than $14 billion in sales. And, Hershey expects China to become its No. 2 market, behind only the United States, by 2017.

|

As a way of further emphasizing China’s role in growing international sales, Hershey recently introduced Hershey’s Kisses Deluxe Chocolates in the country. The candies are twice the size of Hershey’s Kisses Chocolates and feature a whole hazelnut in the center surrounded by rich milk chocolate with crisped rice, wrapped in a special gold foil.

The product was developed to fit with Chinese consumers’ demand for a unique, premium chocolate that offers rich deliciousness and genuine thoughtfulness, perfect for gifting.

Another single-country market that’s receiving attention is India. According to a recently published report by TechSci Research, “India Chocolate Market Forecast & Opportunities, 2019,” India’s chocolate market is forecast to grow at a CAGR (compound annual growth rate) of 18 percent, in value terms, during 2014-19.

The reports points out that consumer preferences in India have gradually transitioned from traditional sweets to chocolates over the last couple of decades. Moreover, targeted promotional campaigns by chocolate companies over the last decade have encouraged the consumers to gift chocolates on festive occasions.

As a result, per capita consumption of chocolates has also grown tremendously from 40 grams in 2008 to 120 grams in 2013, the study points out. Currently, Cadbury is the market leader in terms of total chocolate sales, followed by Nestlé. But the sheer population numbers, fueled by the continuing growth of a middle class open to purchasing more premium confections, has a broad range of players interested in joining the fray.

|

“Attracted by the country’s growing appetite for chocolates and increasing sales in the premium segment, various international chocolate manufacturers like Mars, Patchi, Hershey, Lindt and Fererro Rocher have forayed into India,” says Karan Chechi, research director with TechSci Research, a research based global management consulting firm. “Companies like Mars, Patchi and Hershey are even focusing on opening up brand-specific stores.”

Another megamarket coming into its own is Brazil. As a Euromonitor International report cites, “The rise in disposable income among consumers, especially the new middle-class consumers, is increasing the consumption of chocolate confectionery. Consumers are changing their confectionery preferences, preferring to purchase chocolate instead of sugar confectionery and gum.”

|

As a result, chocolate confectionery is expected to register a CAGR of 7 percent in constant value terms during the forecast period between 2013 and 2018, Euromonitor says. In volume terms, chocolate confectionery is set to post a CAGR of 6 percent for the forecast period.

Long known for its predilection for chocolates, Russia seems to be another expansive market place full of opportunity. Its successful staging of the past winter Olympics, however, has been overshadowed by its annexation of Crimea and involvement in eastern Ukraine. Despite the ongoing threat of increased U.S. and European Union sanctions, multinationals see strong continued growth potential.

Mondelez International, for example, recently announced it would build a new $110-million factory in Siberia to produce Milka, Picnic andAlpen Gold chocolates and Jubilee, Barni andTUC biscuits.

|

Resolution of the crisis would go a long way in assuring positive growth for confections in Russia. No doubt Mondelez believes that cooler heads will prevail. Nonetheless, armed conflict can, as evidenced by the demise of such a strong confectionery market like Libya, obliterate any kind of growth.

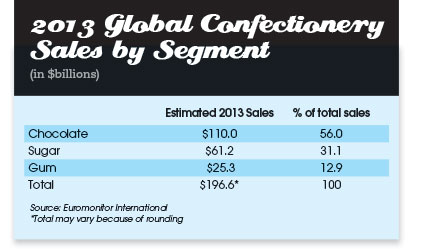

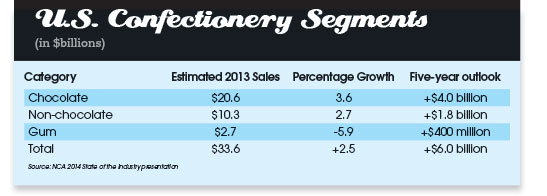

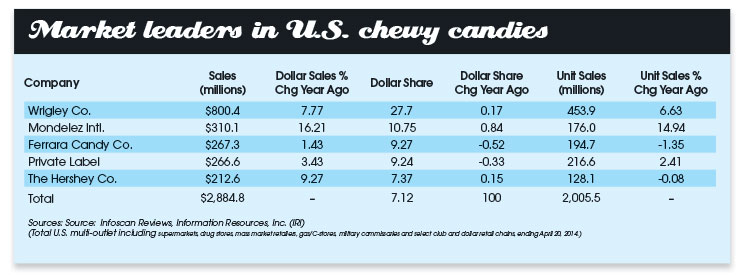

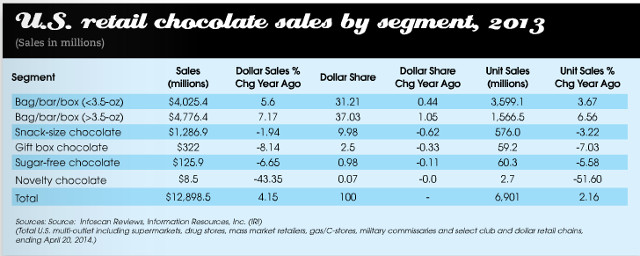

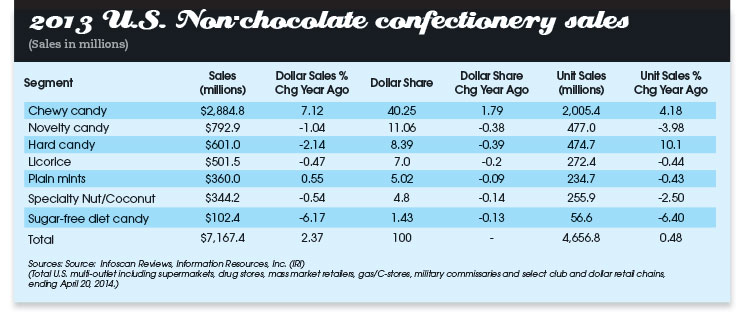

And then there’s the United States, which is coming off a solid year regarding confectionery sales, particularly with regards to chocolate. Indeed, chocolate appears to garner a larger share of not only U.S. confectionery sales, but the world as well.

|

|

In 2012, global chocolate sales were estimated at $107.4 billion; in 2013, they reached $110 billion. More importantly, total share gained .4 percent. Sugar sales also rose, from $59.4 billion in 2012 to $61.2 billion in 2013. It also posted a .4 percent share gain. Gum sales slipped in 2013, dropping from $36.4 billion to $25.3 billion, a .8 percent share decline.

So what’s driving chocolate sales in the United States, and in general, around the world? A Mintel report on U.S. chocolate sales noted that dark chocolate grew $102 million or by 9 percent in 2013 compared to milk chocolate sales increasing by 6 percent or $409 million.

Two specific areas that represent growth sectors for chocolate in the United States are seasonal sales and snack sized products, the same Mintel report asserts.

For example, seasonal chocolate sales grew 14 percent from 2008-13, researchers at Mintel point out. And although Easter chocolate makes up the largest share of seasonal sales, Valentine’s offerings posted the largest growth from 2011-13. As the Mintel report states, “Users of these products are encouraged to think beyond partners in their purchase decision, and to celebrate the holiday spirit with friends and co-workers.”

The researchers at Euromonitor International see the same trend. They forecast strong growth in seasonal chocolate in both the premium and mass segments, with a 4 percent current value increase in 2013 representing $2.6 billion in sales.

As they point out, “Seasonal chocolate has historically had relatively depressed sales, but in 2011 began to experience strong growth. This growth largely stemmed from price increases by numerous manufacturers, as well as increased interest in the category due to the introduction of premium products, along with a renewed focus from consumers on treating holidays as an appropriate time to indulge. These holidays include Valentine’s Day, Easter, Halloween, Christmas, Thanksgiving, and generally any holiday which is typically associated with gift-giving or eating.”

|

But gifting isn’t the only trend boosting chocolate sales; snacking is all the rage. According to Mintel, snack-size chocolates grew 24 percent from from 2008 to 2013. During the last couple of years, major manufacturers have launched miniature versions of their major brands, which helped drive sales amongst the steadily growing snacking audience in the United States.

As the Mintel reports notes, “Snacking in-between meals has steadily become much more common amongst many consumers as a simple way to stay satiated all day. Chocolate producers therefore started to introduce smaller bite-sized portions, which help to fill this snacking desire. In addition, the smaller pieces allow for increased calorie control on the part of the consumer, who might think an entire bar of chocolate is too much.”

|

Other trends that Euromonitor International researchers see occurring with the chocolate category in the United States include:

- Tablets should see their fastest growth in 2013, posting $2.6 billion in sales and a 5 percent growth gain. This growth comes from numerous premium brands, which have started to become immensely popular amongst consumers. In addition, mass-market brands such as Hershey have been able to maintain sales growth despite the movement toward premium chocolate.

- Unit prices of chocolate confectionery once again faced strong pressure in 2013 and are expected to increase by 3 percent. Growth is being led by the miniature versions of countlines being introduced by both Mars and The Hershey Co. In addition, the growth of premium chocolate brands in tablets is further influencing unit prices.

- Plain dark chocolate is expected to see moderate growth in tablets in 2013, registering an increase of 5 percent in current value terms to reach sales of $521 million. Amongst the various types of tablets, dark chocolate consistently gained share over the review period. Much of its success derives from continued launches by manufacturers of new varieties with a higher cocoa content. In addition, many medical studies over the last few years attributed numerous health benefits to the consumption of dark chocolate. Plain white chocolate, however, is expected to see the most growth in tablets, albeit from a much smaller base. White chocolate is expected to increase by 6 percent in current terms in 2013, to reach sales of $139 million.

- Ethical marketing continued to make inroads, not only amongst the big boys, such as Mars and Hershey, but with several boutique and artisan companies.

- And the beat continues for more health-focused snacks, some of which use cocoa and/or chocolate. As Euromonitor points out, “Other snacking categories are introducing new products which are increasingly health-focused. In snack bars and sweet and savory snacks, companies are introducing new products which are increasingly focused on being both healthy and tasty, to give the consumer the sense that they are indulging, without feeling bad about it. Chocolate confectionery may have trouble competing, as it is commonly seen as just an indulgence. However, recent studies about the positive health effects of dark chocolate may be one area on which chocolate confectionery could capitalize.”

It’s an area that could bring in new consumers.

A recent report by Fona International on dark chocolate reveals that 4,144 new dark chocolate products were introduced between 2009-2013. And earlier this year, at a gathering of the American Chemical Society, scientists revealed they had discovered why chocolate is good for you. Specfically, chocolate-loving microbes in the gut convert an indigestible part of the chocolate into anti-inflammatory compounds.

As John Finley, the Louisiana State University scientist who led the study explained to Science Daily, “When these compounds are absorbed by the body, they lessen the inflammation of cardiovascular tissue, reducing the long-term risk of stroke.”

Now that’s better living through chocolate chemistry. Nonetheless, there was no immediate surge in dark chocolate sales after the scientists released their study. Consumer awareness and acceptance takes time.

But word-of-mouth is a powerful tool; just ask the entrepreneurs at Vintage Confections.