The Bottom Line:

- Confectionery industry sales continue to grow

- Manufacturers and retailers must work together to be successful

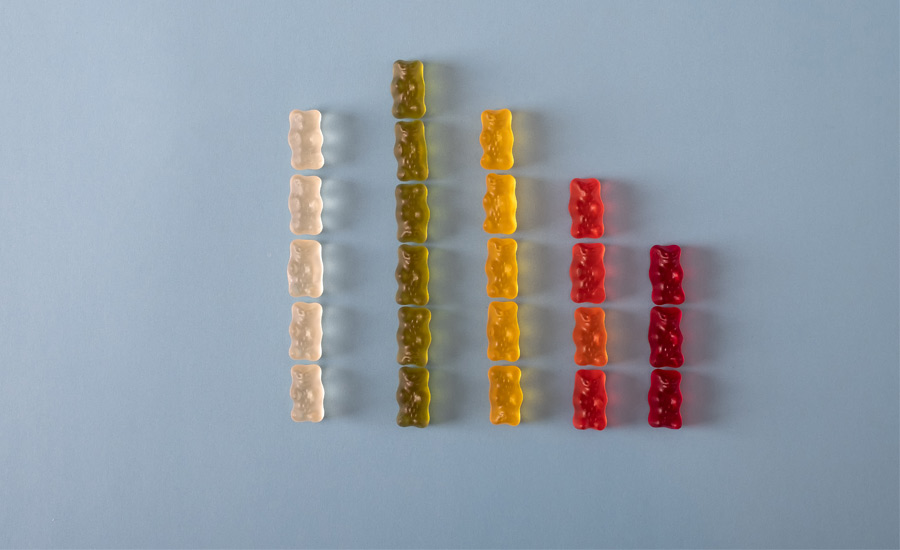

- Consumers enjoy confections 2.4 times per week on average

Candy State of The Industry Articles:

Over the past year, the candy and confectionery industry had its ups and downs but mostly flourished.

“Chocolate and candy have proven themselves resilient—especially throughout the COVID-19 pandemic and lingering economic uncertainty,” says Carly Schildhaus, director of public affairs and communications, National Confectioners Association (NCA). “In 2022, the confectionery category saw sales growth of more than 11% as consumers look to celebrate seasonal moments longer and make everyday celebrations a little more enjoyable. The 2023 State of Treating report has even more great data to use.”

The report states that “supply chain disruption, 40-year high inflation, and lingering COVID-19 concerns continued to affect confectionery shopping and consumption patterns in 2022. Consumers described life as ‘expensive’ and ‘somewhat stressful.’”

However, despite double-digit category inflation, 74% of consumers agree that confectionery remains an affordable treat, the report says. To continue buying confectionery goods, 45% of consumers applied one or more money-saving measures in 2022, switching between types, brands, pack sizes, and stores, it notes.

Unsurprisingly, 81% of consumers see chocolate and candy as a fun part of life and 78% believe confectionery sharing and gifting are great traditions, according to the report.

“Enjoyment occasions include everyday treating for no particular reason to holidays or special celebrations, such as birthdays, trips, or movie nights. Consumers report having a confectionery treat an average of 2.4 times a week, which is consistent with government data that shows Americans enjoy chocolate and candy two to three times per week, averaging about 40 calories and just 1 teaspoon of added sugar per day,” the report adds.

According to data from Circana, over the last 52 weeks ending May 21, the chocolate candy category brought in $18.78 billion in sales, with an increase of 9.2%, and the non-chocolate candy category brought in $10.95 billion in sales, with a healthy 14.7% increase.

In addition, the gum category brought in $3.1 billion in sales, with a 16.7% increase from the same time period last year.

Industry challenges

“Many industries continue to face supply chain challenges and the confectionery industry is certainly not immune to those—but manufacturers are working closely with their retail partners to ensure that Americans can find those treats that they consider an affordable indulgence to bring joy to holidays, celebrations, and every day,” says Schildhaus.

“In addition, the current state of the U.S. sugar program is causing immense challenges for the confectionery industry and American consumers alike. This outdated program is fanning the flames of increased food costs, forcing American consumers to pay $2.4 billion to $4 billion more per year for food—and meaningful and reasonable modernization to the program in the 2023 farm bill will help to alleviate these challenges,” she suggests.

Lisa Burkart, category development manager, ECRM, says that candy has always been one of its best categories in food and beverage, as well as one they’ve been hosting the longest.

“It was tough to see the struggles suppliers and retailers endured through the pandemic. Many were trying their best to maintain offerings where we are starting to see a shift with more innovation and new concepts as we're coming into 2024, and that's exciting,” she comments.

One focus that ECRM heard from suppliers was on better-for-you options and being more mindful with ingredients they're using.

Better-for-you options were definitely plentiful over the last year, with companies like YumEarth, oomph! Sweets, and Chocxo offering candy made with either organic ingredients or with less sugar than traditional sweets.

“Consumers are more health-conscious and suppliers recognize they may need to make some adjustments to appeal to more consumers,” Burkart notes. “Suppliers continue to face supply chain issues causing them to make adjustments to their timeline and even their product offerings. Many are being forced to look at their product lines and focus efforts most on top-selling items and/or flavors that will make the most impact.”

Along with supply chain, suppliers are also dealing with their cost of ingredients, packaging, and more rising, while still trying to supply retailers in the ways they used to—that's a big challenge, she adds.

“In some cases we're hearing that it's not only cost that is a struggle, but some manufactures are not offering all they used to and suppliers may not be able to get the ingredients needed and could be forced to find a new source,” Burkart says.

However, she notes, producers have risen to the various challenges encountered through the past year.

“[Producers are] getting creative—finding new ways to package or ship items so they can continue to fulfill the buyer's and consumers’ needs. Since we've seen more gatherings come back this year suppliers have capitalized on ‘share’-size bags encouraging consumers to share with a friend,” Burkart relates.

Shifting landscape

The future is bright for the confectionery industry, Schildhaus says.

“Innovation has always been at the center of what our member companies do and that’s never been more evident as they continue to find new and exciting ways to delight consumers right alongside their classic and nostalgic favorites. At NCA, we look forward to continuing to promote and advocate on behalf of the industry—in Washington and beyond,” she adds.

Burkart predicts the industry will continue to see a lot of the same as last year, but on the positive side, candy sales continue to rise.

“Each season seems to outdo the last because people connect through candy and we all want to get back to feeling a sense of togetherness,” she relates.

ECRM hosts five candy sessions per year—four are seasonal, and its largest is Everyday Candy, which is coming up August 27–30 in Chicago, Burkart shares.

“Our sessions are truly one of a kind, offering curated, one-on-one pre-scheduled appointments with decision makers in the candy space across multiple channels. We also offer networking and educational opportunities so it's a one-stop shop,” she notes. “Our RangeMe platform is also key to staying in front of buyers and top of mind all year long.”

Burkart offers some advice for industry colleagues on how to succeed over the next year: “At ECRM we're all about back to basics—we're excited to be transitioning our sessions back to in-person, which is what we all know and love. In the candy category specifically, there is a comradery where this group feeds off each other and really supports each other. Both the buyers and sellers thrive off of the interaction, and we're happy to be a place to harness those relationships and create new connections.”