Long heralded as a way to reduce overall sugar intake without cutting indulgences altogether, sugar-free confections give consumers a way to have their sweets and eat them, too.

And they have been eating them. Recent data from IRI, a Chicago-based research firm, shows sugar-free gum accounted for more than 80 percent of the $3.12 billion U.S. gum market in the previous 52 weeks ending Oct. 30. Meanwhile, sugar-free chocolate pulled in nearly $115 million, and sugar-free diet candy brought in almost $100 million during the same period.

Despite occupying considerable chunks of their respective market segments, sales of sugar-free confections are flat or sliding downward. Sugar-free gum dollar sales dipped 1.57 percent and unit sales dropped 4.82 percent over the last year.

Sugar-free chocolate hasn’t fared much better. Dollar sales sagged 3.17 percent and unit sales fell 14.11 percent in the same period. Sugar-free diet candies posted a small gain in dollar sales — 1.04 percent. However, unit sales shrunk 3.2 percent.

Tyler Merrick, founder of Project 7, a San Clemente, Calif.-based manufacturer of gummies and sugar-free gum, said a need for creativity might have contributed to the decline.

“One of the challenges with our (sugar-free gum) category and why it’s shrunk over the years or held flat is there hasn’t been a lot of that because it’s been predominantly owned by a handful of brands,” he says. “There hasn’t been that innovation that’s encouraging people to come back into the category and try something different.”

But that’s where Project 7 shines, Merrick says. His company — which made $7.4 million in sugar-free gum over the year ending in October, according to IRI — offers unique flavors that can spice up consumers’ chewing gum rotation.

Project 7 offers gum in Birthday Cake, Coconut Lime, Front Porch Lemonade, Grapefruit Melon, Kettle Pop, Peppermint Vanilla, Rainbow Ice and Wedding Cake flavors, but Merrick says more will come to market in 2017.

Last year, Project 7 also introduced its Build+A+Flavor line, which takes a flavor such as S’mores and breaks it down into elementary flavors such as Choco Graham and Toasted Marshmallow. Consumers can chew all the flavors separately or combine them in ratios they choose.

“It’s showing people the fun of mixing and having new flavor experiences in gum,” Merrick says. “That’s been a lot of fun.”

Nicole Rivera, marketing director for Bazooka Brands, a division of the Topps Company, also said innovation is key to reviving stalling categories.

“It’s like this self-fulfilling prophecy,” she says. “People see that gum is declining so they get out of gum, but meanwhile, the people who are seeing the benefit of it are the people who are investing behind gum innovation and diversifying their gum set.”

Bazooka pulled its sugar-free products in the early 2000s, but consumers asked the company to bring them back. In January 2016, Bazooka launched a sugar-free coated pellet with the iconic Bazooka flavor. In mid-2016, they released sugar-free products licensed under Disney’s Frozen and Marvel Avengers movie titles.

Rivera notes the sugar-free portfolio has grown Bazooka by 20 percent since the start of 2016, and there’s more to come in 2017 and 2018.

“We make sure that the flavor profile is true to Bazooka,” Rivera says. “We also make sure that we are providing people with their favorite characters.”

Flavor innovation is only part of the equation, however. Consumers with particular diet restrictions or preferences turn to sugar-free products to reduce sugar consumption or limit intake of non-natural ingredients.

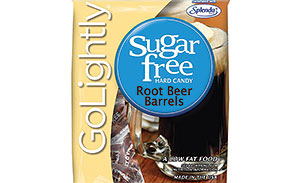

For some, it may mean replacing favorites from their youth. Sandy Gencarelli, director of marketing and export sales for Hillside Candy, says the manufacturer recently added root beer barrels to its lineup of Splenda-sweetened GoLightly hard candy, which includes butterscotch and starlight mints.

She notes root beer is a “classic Americana” flavor that provides nostalgia, particularly to customers watching sugar content because of diabetes or other health concerns.

“It’s a sweet treat to them without the sugar spike of a regular root beer float,” Gencarelli says.

Splenda is a consumer brand for sucralose, a sweetener that has no calories or carbohydrates. It also holds up to heat, making it functional for cooking and baking applications. But it’s not exactly natural.

That’s why some confectioners, including Project 7, have turned to stevia, a noncaloric plant-based sweetener.

Merrick says this year Project 7 will roll out gums that use a stevia-xylitol blend, which offers the natural component, as well an outlet for reducing sugar consumption.

“There’s a mix that’s usually required, we found,” he says. “It doesn’t do very well to have just one sweetener in that sense.”

Pennsylvania-based Lily’s Sweets, founded by Cynthia Tice and Chuck Genuardi, has used stevia in its products since 2011. Lily’s offers a range of dark and milk chocolate bars and dark chocolate baking chips.

“With flavors meticulously chosen to create the most mouthwatering chocolates, Lily’s Sweets’ products offer 20-25 percent fewer calories than conventional chocolates (it’s the Stevia), but 100 percent of the indulgence,” reads media material on Lily’s website.

And soon, Lily’s may not be alone in the alternatively-sweetened chocolate market. Nestlé announced in November 2016 its researchers have found a way to structure sugar differently so it dissolves faster and doesn’t take as much to obtain equal levels of sweetness in products.

With this development, Nestlé says it will reduce the amount of sugar in its confections in 2018. More details on this rollout are expected to come this year.

“This truly groundbreaking research is inspired by nature and has the potential to reduce total sugar by up to 40 percent in our confectionery,” said Stefan Catsicas, Nestlé chief technology officer. “Our scientists have discovered a completely new way to use a traditional, natural ingredient.”

Natural or not, consumers will likely continue to seek out unique ways to reduce sugar intake and balance their diets. For confectioners, meeting that demand will pose a sweet challenge.