The Bottom Line:

- Labor shortages continue to impact snack and bakery operations

- Direct-to-consumer sales increases are changing warehousing and logistics

- Robots will not completely replace humans in warehouses anytime soon

Picking robots, automated storage and retrieval, and software that predicts future demand are among a host of technology, equipment, and strategic changes that snack food and wholesale bakery companies are undertaking in their warehousing and logistics functions.

Rebecca Marquez, director of custom research at PMMI Media Group, sees technology in general increasing in warehousing. In some cases, companies have difficulties seeing the ROI given the costs involved, but the challenges in finding skilled workforce and increases in direct-to-consumer sales are pushing firms toward automation in warehousing.

“Picking robots are being employed, and then also, companies are looking into AGV [automated guided vehicles] technology,” she says. “The companies we talk to are not seeing a return on that, so they’re looking at remote-controlled forklifts and things of that nature for replacing manual labor, along with co-robots and robots.”

PMMI’s latest report on warehousing (which included food fields outside of snack and bakery) found that mobile robots, automated bagging, boxing and cartoning; automated palletizing, depalletizing and storage; and automated sortation systems and conveyors are all becoming more common, Marquez adds.

The shift to direct-to-consumer shipping is greatly impacting company warehousing and logistics strategy, says Marquez of PMMI, since they’re used to sending SKUs in bulk to retailers—not piecemeal to individual consumers. “That, for many companies, is still very manual,” she says. “They’re looking at automated picking machinery that remote-controlled. That’s what companies are going to have to start implementing. You can’t do these mixed orders with one person walking around—it’s how they’re doing it now, but it’s not efficient.”

Technology and software

Snack and bakery companies are struggling to find the best options when it comes to tracking technology and software because there are so many choices, says Phil Biga, senior product manager for RPM at Orbis Corp. “In some cases, Bluetooth is the best way to keep track,” he says. “In some cases it’s RFID. It’s almost a full-time project to figure out what’s the right fit for the return on investment of tracking your packaging.”

Many choose RFID for its affordability, although it requires “some infrastructure for sure” and a line of sight for the tag to be trackable, Biga notes. Bluetooth and GPS can track and measure the supply chain in a way that tells you where gaps exist and gives information like how many reusable pallets you need to maintain inventory.

Nathan Brown, chief technology officer at EVS LLC, sees considerable automation in the snack and bakery space, although it’s not a “total takeover,” he says. “It’s people and machines working together, but more machines showing up. We’re seeing cobots, which is great for integrating. The larger macro trend is a more tightly integrated physical and digital world working together: The physical world is growing into the digital world with automation; the digital world is growing into the physical with telemetry and digital twin.”

With companies hurting for labor the past couple of years, they’re trying to create a work environment that people want to enter, and technology is assisting with that in deploying systems that people can pick up and use without having to go through much training—or that provide additional benefits, Brown says.

“For example, the deployment of digital workplace safety; can I detect if a worker falls? Can I detect if there’s a collision? Can we use watches to tell if somebody’s having a cardiac event?” he asks. “Once you have a smartphone, which is a mobile computer, on the shop floor with the worker, it becomes a platform to bring all kinds of value-added experiences.” That dovetails with the needs and desires of Gen Z workers, he adds.

Matt Brown, CEO of Wherefour Inc., sees snack and bakery companies using technology and software to predict future demand, in the wake of the supply chain unpredictability during the pandemic. “Randomness crops up, and being able to predict, forecast, and plan around shortages, and changing suppliers, which can be a real challenge for any business,” he says. “But especially bakeries, with daily production and fresh product, you’re not going to make sales if they don’t have something to sell today. Managing inventory is a real risk factor.”

Wherefour has noticed more customers using GS1 barcodes to boost transparency and traceability, Brown says. “It’s an interesting bar code in that it’s got some data baked into it,” he says. “When you scan it, it has expiration dates, and sometimes vendors put UPC codes and things like that. If you pair that with a traceability system, you have some potential to be able to scan and quickly determine where that stuff is going. You can at least determine where it’s been.”

Technology also can be helpful with ingredient transparency, particularly in an age where end consumers want to know the details of claims. “Consumers are starting to be more aware and more slightly aggressive about learning and who’s using organic flour, or who’s using flour from a certain country,” he says. “Is it really gluten-free? People are paying more attention to what they’re consuming. For bakeries, they need to think about how they’re going to provide the visibility.”

While RFID is not a brand-new trend, it’s continuing to grow as companies look for ways to quickly find, scan, locate and order-pick a pallet within their inventory, says Derek Jones, marketing manager at Robopac USA. And use of third-party logistics companies continues to grow.

Wes Bryant, product manager at AMF Bakery Systems, sees technology and software being deployed for order correctness and product tracking. “You go into a bakery, and you go in six months later, a lot of the warehouse workers were not the folks there six months earlier. By using software for product tracking, you shorten that training time. The software does most of the thinking for them,” he says. “With allergens, you want to make sure you’re not mixing products, not shipping the wrong price to the wrong customer. That’s where software for product tracking comes into play.”

Equipment and transportation

Orbis has seen a trend toward tracking trays with sensor technology and RFID solutions, Biga says. The trays themselves are not the concern as much as the product they contain. “Companies are interesting in using this, but they’re not sure how to make it work,” he says. “The trays are not super expensive, it’s the product that’s on them. To get return on investment, it’s about how to keep track of your vessels—whether that’s trays or dollies—and how can they manage those?”

Internet connectivity of larger equipment like mixers and ovens seems like a major boon to Brown of Wherefour. “Having some of that covered by technology would be fantastic for the industry, rather than manually tracking, ‘This mixer has been in service for 50 hours and needs to be cleaned,’ ” he says. Mobile devices are also extremely helpful for drivers and people in a production facility, he adds. “They’re not going to drag it computer around with them. They need something that is food safe, sanitizable, and transportable.”

Brown has noticed customers using GPS to manage their fleets, which isn’t a brand-new concept but it’s new to certain industries, he says. What’s more, he says he’s seen a trend toward use of risk-management policies and standard operating procedures, given risks around contaminated materials, as well as better or more robust planning. Operators figure: “Our business is scaling, we can’t wing it like we used to,” he adds. “There’s lot of variability in supply these days. We need a solid plan so we’re covered in case there’s some factor we need to deal with.”

More and more companies are wanting to wrap and weigh products, given that shipping costs are going through the roof, says Jones of Robopac. “It’s good to know what a load weighs,” he says. And Jones also sees growth in cold storage. “People are looking for equipment that’s freezer-package-equipped,” he says.

Overall strategy

Part of Orbis’ strategy has been to focus on customer requests for flexible space, given that they need different amounts of square footage at different times of year, Biga says. “How do you accommodate something like that?” he says. “I have customers who tell me, at certain times of the year, ‘I have 100,000 square feet of space available. Do you know somebody who wants to sublet it? How do I optimize that space so I don’t have dead warehouse space?”

Warehousing companies also come to him with a list of marketplaces and square footage they’re looking to fill. “There’s certainly available space,” Biga says. “The strategic approach is the right location. You want to maximize return on transportation, and say you want to be an eight marketplaces. If you have a lot of customers in a certain area, that’s where you want to be focused.”

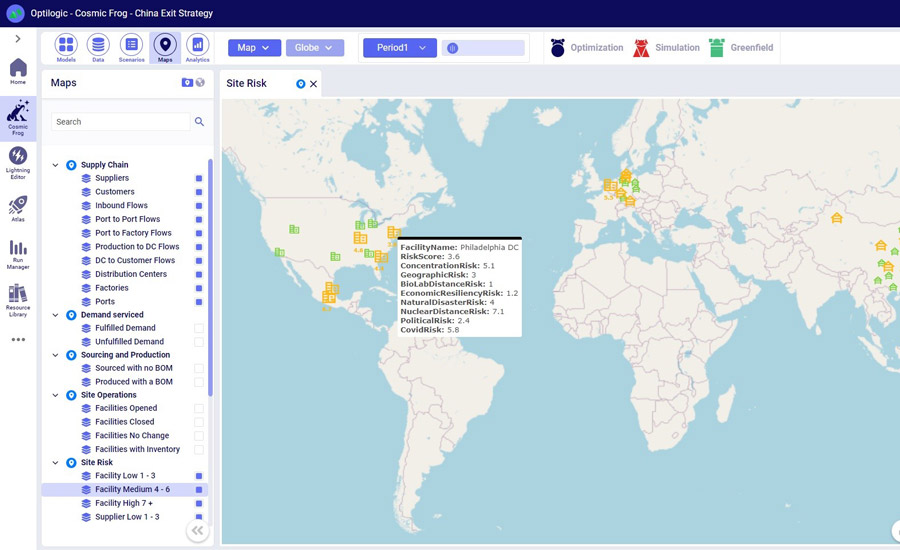

Snack and bakery companies need to use tools and technologies to simulate scenarios like what happens if they have a shortage of space, or if a motor carrier goes out, says Ryan Polakoff, president of third-party logistics provider Nexterus. “I’m making sure that if any of this stuff happens, I’ve got an operating plan in my back pocket that I can deploy,” he says. “Coming out of the pandemic, they’re looking at equipment and using tools to say, ‘Based on the demand of my network right now, what does it make sense to sub out?’ Companies are becoming more prepared in what they need to do.”

Firms are examining whether the network they have right now is the one they will need in the next one, three or five years, Polakoff says. “I have these warehouses. Do I need this space?” he says. “What does that create for my operation, and the orders coming in. There’s been a surge in proliferation of warehouse simulation. These studies are running rampant left and right, certainly not exclusive to anyone industry. Nobody knows what’s next. There are conflicts geopolitically; carriers are going out of business. Companies are becoming more aware of simulating the risk component, [and determining] what is the plan if it affects their network.”

Wayne Ortner, general manager of FlexiBake, has seen more manufacturers opening a central commissary kitchen to produce products for their own retail fronts as well as other wholesale accounts.

“The blend of retail and wholesale allows the business to operate a full manufacturing facility that can deliver to other B2B clients, while still having the creativity comes with operating their own retail fronts,” he says. “Having the retail side of the business allows the company to build a much stronger community following, and keeps the wholesale side of the business to produce a the higher volume of products needed to scale up and run a more sophisticated manufacturing facility.”

AMF has noted a strategy toward more automated order makeup, Bryant says. “You can run a product in bulk over eight hours of production, but the end user may not need an entire pallet or entire stack worth of product,” he says. “We’re beginning to look at breaking those down, and building a mixed-product order for the customer. For a lot of the smaller distributors, that’s something I do see coming about in the next few years.”