Bakers and snack food producers face many challenges when delivering their products to customers on schedule. In a competitive marketplace, they need to make sure their products are on the shelf when consumers want them. Factors such as traffic delays and driver deviation have a big impact on delivery efficiency. Late and failed deliveries result in unhappy customers, which can impact future orders and the bottom line.

Increasingly, retailers are demanding that their suppliers hit tight time delivery windows. Doing so requires more visibility of deliveries, estimated time of arrival (ETA) and late notifications, as well as delivery and merchandiser coordination. In addition, some stores no longer have sufficient floor space to warehouse large deliveries to meet daily demand, and thus are requesting multiple deliveries of fresh product throughout the day.

“We are seeing a trend toward more stock keeping unit (SKU) proliferation resulting from new segments such as lifestyle foods—health-and-wellness—and regional and international selections,” says Kelly Frey, vice president, product marketing, Telogis, Aliso Viejo, CA. “This is driving less shelf space per product, and more-frequent, smaller deliveries to minimize out-of-stock items, which requires better delivery coordination and route optimization.”

In addition, online shopping and home grocery delivery is impacting traditional bakery and snack food segments. Grocers that offer such services must be sure they have enough inventory on hand to be able to fulfill online orders completely and quickly.

Optimizing delivery routes

Luckily, route-optimization systems are available to help bakers and snack producers improve their delivery process. Onboard computers enable fleet drivers to manage deliveries and offer value-added services such as scanning delivery, capturing delivery exception, real-time communication with the home office and signature capture for proof of delivery (POD).

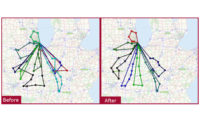

“Using an automated route-optimization solution helps to streamline processes, produce realistic and achievable plans, and ensure that costly transportation resources―and fuel―are used as efficiently as possible,” says William Salter, managing director, Paragon Software Systems, Frisco, TX. “However, route optimization is a complex process with many variables and constraints that need to be taken into consideration.”

Electronic POD forms and real-time, automated ETA notification using a vehicle global positioning system (GPS) are the two biggest developments improving the delivery process, according to Frey. “Drivers can scan product on and off the vehicle using smartphones or tablets and auto-generate a POD for signature, including out-of-stock/damaged (OSD) notes, along with auto-arrive/depart status notifications to the customer or back office.”

Mobile devices—especially smartphones—are running at 85–95 percent industrywide among delivery fleets, Frey adds. This allows virtually any fleet, no matter the size or technological sophistication, to take advantage of various applications designed to maximize productivity. “The key to success for bakery and snack food producers is to choose solutions that leverage one platform that encompasses routing/scheduling optimization, order management and driver compliance,” he explains.

The Paragon Software Systems transport-optimization system holds a host of details, including customer addresses, delivery quantities, time-frame windows, vehicle sizes and driver shift details. The software uses digital mapping to calculate the most-effective delivery and collection sequences with accurate journey times, while allocating loads to appropriate vehicles and drivers accordingly. This ensures that schedules are geographically feasible and can meet promised arrival-time windows. It also improves fleet utilization and productivity, while reducing total mileage incurred.

Paragon also offers new “Arrivals Board” functionality to its routing and scheduling systems, which links to satellite vehicle tracking via the Paragon Fleet Controller. The system sends continually updated, visual ETAs to store personnel, informing them when the delivery will arrive and on which vehicle. “The Arrivals Board makes it easy to manage multiple deliveries by ensuring that enough people are available to handle offloading and for turning the vehicles around on time,” Salter notes.

The Distrib Software Suite from Pcdata USA, East Granby, CT, can be used to log shipments to the final destination. The module scans barcode labels, which identify product, quantity, customer and route; it then generates a load manifest with all contents of the trailer listed. Mobile units can be used to scan the product at the final destination to confirm delivery.

The Distrib Software Suite also provides a system that tracks baskets to the final destination, says Marc Braun, president, Pcdata. “Drivers simply log in the number of baskets collected at a customer site, and the data is immediately updated at the plant. Reducing basket loss costs offers big savings.”

Tracking driver behavior

New tools are available to manage the behavior of fleet drivers, which further improves delivery efficiency. On-board computers (OBC) are now prevalent in the transportation industry. OBCs collect data from a truck’s electric control module, which captures engine data from the tractor, making every action of the driver reportable to the dispatcher. OBCs manage driver behavior as it pertains to DOT hours of service, safety and fuel economy. In addition, by tracking a truck’s movements, the systems tell drivers when it’s time to take a mandatory break or layover.

“This information is readily available to the driver’s manager at any time as well, which ensures compliance with the law,” says Scott Teal, director of customer logistics, Ryder System Inc., Miami. “The OBC can report when a driver is idling the truck more than necessary, exceeding a predetermined threshold of RPMs or exceeding the speed limit. These more-nuanced elements improve both drive safety and fuel economy.”

Easing pain at the pump

Constantly fluctuating gas prices makes it challenging for manufacturers to maintain profit margins. While precise route planning can help in this area, so can alternative fuels. For example, the use of compressed natural gas (CNG), which offers clean-burning qualities and lower costs than gasoline and diesel, is on the rise.

Delco Foods, Indianapolis, has converted a third of its fleet to CNG. The company plans to convert seven to 10 trucks by the end of 2015; eventually, all of its tractors will be CNG. “The market fluctuations of diesel are one reason why Delco Foods decided to switch to CNG,” says Doug Deardorff, vice president of operations. “It is a more market-stable product, which allows us to more accurately forecast our fuel costs.

“Several years ago, you pretty much had to keep a CNG truck local because of capacity constraints and limited refueling options,” continues Deardorff. “Now, with trucks able to go 400 miles and fueling options in most cities, you could run a CNG truck from coast to coast. Delco Foods is committed to CNG for the long-term. As our geographic footprint grows, we are confident there will be more CNG stations to meet our needs.”

Alpha Baking Co. Inc., Chicago, has experimented with waste vegetable oil, propane injection fuel, hydrogen injection fuel, biodiesel and CNG. In 2013, it introduced a fleet of delivery vehicles powered by 100 percent liquid propane fuel. The bakery maintains a fleet of more than 330 vans and trucks, with electric engines and governors that keep the maximum speed to 62 miles per hour to optimize fuel consumption. (For more on Alpha Baking, see “Growth Through Diversity,” the cover story in the August 2015 issue of Snack Food & Wholesale Bakery.)

Isuzu Commercial Truck of America Inc., Anaheim, CA, offers both CNG and liquefied petroleum gas (LPG) options on its N-Series truck. LPG-fueled vehicles produce significantly lower amounts of harmful emissions and carbon dioxide, according to the company. “We’ve seen a change in this area, though,” says Brian Tabel, executive director of marketing. “As the price of gasoline drops, demand for alternative fuels is not as high. However, many business owners understand the benefits of CNG and LPG and have received incentives to use those alternative fuels.”