In 2015, Americans’ top three resolutions were, according to Nielsen, staying fit and healthy, losing weight and enjoying life to the fullest. While the data for 2016 is not yet available, it’s safe to assume that at least one—if not all—of these resolutions is on most people’s list again.

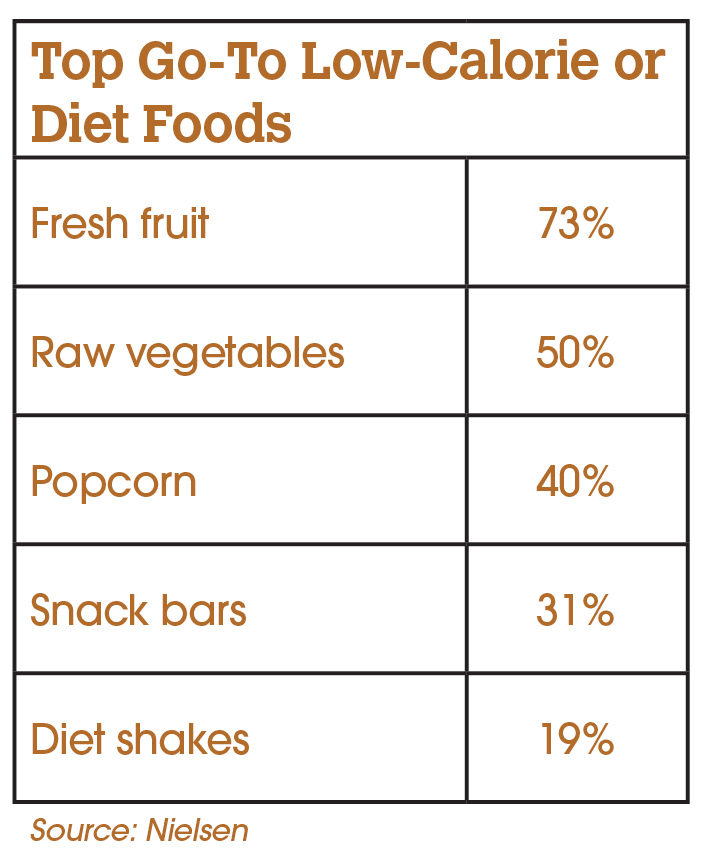

People who resolve to lose weight and be fit often turn to favorite go-to foods. A Nielsen survey on this topic reveals that fresh fruit, raw vegetables and, surprisingly, popcorn and snack bars top the list (Nielsen online survey of U.S. respondents between Dec. 29, 2014 and Jan. 2, 2015.)

Are consumers redefining the foods they will take along with them on the road to better health?

Emerging preferences

Although weight-conscious consumers often try to reduce their sugar or fat intake, they still want to eat snack foods. “Consumers are snacking more and replacing traditional meals with snacks and bars,” says Ami Krishan, category marketing director, sweeteners, Tate & Lyle, Decatur, IL. “In fact, a recent Euromonitor study indicated that sales of snacks accounted for 40 percent of the $370 billion packaged food market.”

Bars have become as ingrained in consumers’ dietary choices as the sandwich, with several factors driving the category’s growth. According to Ryan Barnett, consumer insight manager, Corbion, Lenexa, KS, bars tie into “two key consumer wants: portability and protein/ fiber. Bars are built for eating on-the-go and for an afternoon snack or quick breakfast.”

Catherine Barry, director of marketing, National Honey Board, Firestone, CO, agrees. “The bar business has been booming for a while, as consumers’ hectic lifestyles have made on-the-go eating a common occurrence,” she says. “We have seen several trends on the bar category. One is clean-label, all-natural products. Consumers are looking at ingredient listings and looking for familiar, natural ingredients that pack either significant flavor or nutritional benefits. Honey has taken center stage on these products.

“We also are seeing growth in the all-natural energy bar category,” continues Barry. “The other segment we’re watching closely is the sweet and savory bar segment. For example, KIND recently launched a new line of Strong & Kind bars designed to act as a replacement for potato chips.”

Another move by KIND Healthy Snacks is the integration of popcorn into a new line of KIND Healthy Grains Popped bars, including a Salted Caramel flavor.

The sugar challenge

Sugar is one of the most commonly used ingredients in bars and by far the top sweetener, a concern for many health-conscious shoppers. According to the American Heart Association (AHA), we consume about twice as much added sugar as we should. AHA recommends daily intake be limited to 6 teaspoons for women and 9 teaspoons for men, so consumers striving for a healthier diet should consider reducing their sugar consumption.

“In the battle of the bulge, consumers are looking for healthy, clean ways to lose weight and become more fit,” says Thom King, president, Steviva Ingredients, Portland, OR.

But today’s consumers want it all. “Although sugar and calorie reduction is important to consumers, that doesn’t change the fact that taste is king,” says Krishan. “Therefore, manufacturers need a sweetening toolkit that meets consumers’ demand for the best of both worlds—reduced sugar and great taste.”

According to Eileen Bielenberg, senior food technologist, Firmenich Inc., Plainsboro, NJ, reducing sugar levels is definitely one of food manufacturers’ main requests when it comes to snack foods and bars, but it also poses several challenges. “Reducing sugar impacts the physical properties of the product,” she explains. “Sugar plays a role in binding, bulking and moisture retention. Therefore, reducing sugar creates the potential need for additional ingredients.

“Additionally, reducing sugar impacts the overall flavor profile,” Bielenberg continues. “In bars, in particular, the balance between sugar and salt is critical, so then it becomes a bit more complicated, because there are flavor implications beyond sweetness that need to be taken into account.”

Better-for-you formulation strategies also often include other measures beyond reducing total sugars per serving. One approach involves the addition of more whole grains. “We then have additional technical challenges presented by the whole grain, such as masking bitterness or cardboard off-notes,” says Bielenberg. Traditionally, sugar has played that function, she notes, but with the desire to reduce overall sugar levels, product developers have to use alternative strategies and flavor tools.

Sweet new tools

Fortunately, ingredient suppliers have developed a number of tools to help product formulators reduce added sugar in bars. “Our TasteGEM portfolio is a collection of complete flavor solutions that help restore taste in products when sugar has been reduced,” says Bielenberg. “We also have a Modulasense collection that includes whole-grain off-note and bitterness maskers and sweet brown note boosters, which also promote the Maillard-reaction-type flavors and appearance in products with reduced sugar.”

Fiber is also a top aspect that’s built into better-for-you snacks. Tate &Lyle’s PROMITOR is soluble corn fiber that meets the needs of developers seeking to simultaneously add fiber and reduce sugar, says Krishan. The ingredient helps reduce calories by rebalancing bulk, viscosity and mouthfeel in reduced-sugar and reduced-fat products.

Steviva Brands is preparing to launch AlloSweet and AlloSweet+ with stevia. AlloSweet (D-allulose) is a low-energy monosaccharide sugar derived from enzymatically treated fructose sugar. AlloSweet has 70 percent of the sweetness of sucrose. AlloSweet+ stevia is about twice as sweet as sucrose. Health benefits of these two sweeteners, according to King, include improved insulin resistance and antioxidant enhancement with a caloric value of nearly zero, which may be of particular benefit to consumers who monitor their sugar intake because they don’t want to significantly impact their glycemic response.

Used together, certain sweeteners can have a synergistic effect. By using smaller quantities of various sweeteners, formulators can often achieve similar levels of perceived sweetness with lowers level of added ingredients.

Stefanie Lee, food scientist, Tate & Lyle, explains that perceived sweetness of blends using allulose are “10 to 40 percent higher than each sweetener alone. Tate & Lyle’s DOLCIA PRIMA allulose works in combination with most commonly used nutritive and non-nutritive sweeteners, and in synergy with certain high-potency sweeteners, such as TASTEVA stevia sweetener. Combining the two helps build back body and mouthfeel, and deliver an even better temporal profile in sweetened snacks and bars.”

When using stevia and monk fruit in formulations, “blending polyols such as Erysweet (erythitol) can mask off-notes of high-intensity sweeteners, such as stevia and monk fruit,” says King. “Breaking sweeteners down to a fine mesh under 100 helps sweeteners dissolve into solution with ease and consistency.”

With all these new sweeteners available to manufacturers, consumers may soon be able to achieve their health goals with the help of convenient snack bars without any associated guilt.