The tortilla category did well over the past year, possibly because people are now staying home and working at home more often, and thus able to cook more elevated lunchtime meals.

Market data

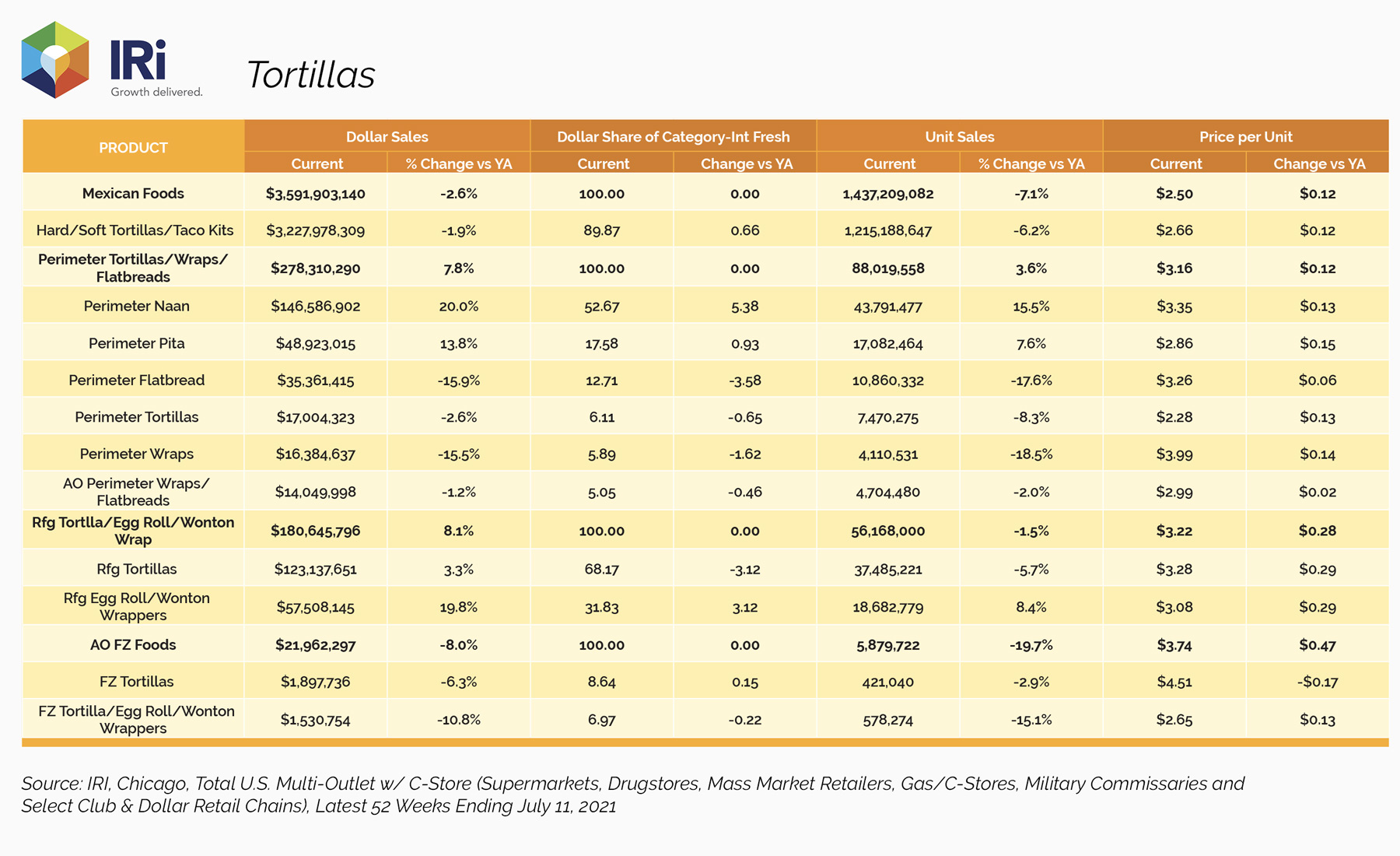

According to IRI (Chicago) data from the past 52 weeks, which ended on January 23, 2022, the “perimeter tortillas/wraps/flatbread” category did well, with an increase of 7.8% and a total of $278 million in sales.

The naan category rose 20%, with $146 million in sales, and the pita category brought in $48.9 million in sales, with a 13.8% increase. Flatbreads shows a 15.9% decrease in sales, with $35.3 million total sales, and tortillas brought in $17 million in sales with a 2.6% dip. Wraps brought in $16.3 million in sales with a 15.5% dip in sales.

The “Hard/Soft Tortillas/Taco Kits” category experienced a slight decrease of 1.9% in sales, but brought in $3.227 billion overall. Refrigerated tortillas had a small increase in sales, by 3.3%, and brought in $123 million in overall sales. Frozen tortillas brought in $1.897 million, with a 6.3% dip, and frozen tortillas/egg roll/wonton wrappers brought in $1.53 million in sales, with a noticeable 10.8% decrease in sales.

A changing market

“The tortilla market continues to change and evolve as the pandemic continues to affect our daily lives. On the retail side, we’re seeing a lot of creativity at home with how people are using tortillas. Much like an item such as macaroni & cheese that is viewed as comfort food, tortillas can play a similar role,” says Ricardo Baez, president, Don Pancho Authentic Mexican Foods, Salem, OR.

“As folks stay home, tortillas are being used more frequently to make cheesy quesadillas, a quick snack such as a peanut butter and jelly wrap, or to replace traditional breads in a sandwich,” he says.

“On the foodservice side, we are seeing the portability of tortillas come to shine with grab-and-go concepts through drive-thru windows, and the incorporation of tortillas into more menu items to help compliment sales of hot food items during lunch and dinner using tortillas as a delicious carrier/transporter of food. Tortillas are providing inspiration to chefs and restaurant operators on how to expand menu options with portable items that can be consumed outside of a restaurant dining experience,” Baez comments.

VJ Chengappa, senior brand manager, Mission Foods, Inc., Irving, TX, agrees that more consumers are consuming tortillas at home.

“With the pandemic seemingly changing consumers’ buying and consumption habits permanently, it has had net positive impact on the tortilla category. People continue to prepare more meals at home, thereby driving an increase in sales. As we approach the 2-year mark for COVID-19, we find that we’ve retained much of the incremental sales we experienced during the pandemic,” he notes.

Alissa Bessette, brand manager, UNFI, Providence, RI, says that tortillas have been one of the biggest winners since the start of the COVID pandemic, with record sales of almost $4 billion, up more than 20 percent from two years ago.

“These sales are clearly tied to the changing consumer behavior caused by the pandemic and the major shift to increased eating at home occasions. On the foodservice side, sales are continuing to recover, though a tight labor markets may suppress growth to some degree in 2022. Mexican restaurants, where tortillas are prominently utilized, are still one of the most cost-effective and popular restaurant formats, boding well for the future of tortillas,” she suggests.

Top trends

Baez says that what continues to drive category growth in tortillas is the ability for products to adapt to an ever-changing environment.

“For instance, on the dietary side, there are tortillas that are formulated to provide reduced carbs to support a low-carb diet with the added benefit of lowering calories and sugars. We are also seeing some continued growth in the organic tortillas, as well as the plant-based/grain-free tortillas and chips,” he adds.

“Many manufacturers are experimenting with items and recipes to diversify their tortilla product offerings in the better-for-you category. It is a learning and adaptive process to be able to hit the ‘sweet spot’ where you can make a delicious and differentiated product that also offers sought-after health benefits,” Baez finishes.

Better-for-you products are seeing unprecedented growth at the moment, says Chengappa.

“The pandemic appears to have provided further support for this segment that was already growing. Consumers are increasingly seeking out products with less sugar and fewer carbs. Also, we have seen impressive growth in the grain-free and alternative flours segments,” he notes.

Bessette agrees, saying that more and more consumers are gaining a better understanding of the calories, carbohydrates, and other nutrients found in tortillas.

“If you look at the entire tortilla category, you can clearly see consumers’ interest is leaning towards healthier tortillas. For example, the fastest growing segment of tortillas are carb-conscious better-for-you flour tortillas, which grew over 15 percent last year, a significantly higher rate than the total category. Consumers interest in low-carb items remain high as several diets, including Keto and Weight Watchers, rely on counting the number of carbohydrates in a meal to adhere to the diet,” she elaborates.

“It’s also important to spotlight the role social media plays as a platform of ideation around the usage of tortillas. Social is a great incubator for all the ways to incorporate tortillas beyond a traditional sandwich wrap, such as flatbread pizza crusts, air fried chips, and homemade crepes,” Bessette adds.

“Specifically, for our Tumaros brand, there is a robust community consistently sharing where to purchase the products, recipes, and inspiration, especially on TikTok and Instagram. At the end of the day, tortillas in general have a very strong and talkative social audience, which is helping drive the growth that we’ve seen,” she finishes.

New and upcoming products

“At Don Pancho, we are excited about our new products we are rolling out and consumers’ positive response, [specifically about] our Don Pancho Grain Free chips and tortilla line. This compliments our low-carb/reduced-carb offerings, as well as our organic tortilla/chip line. These products certainly support the better-for-you category and are relevant to today’s consumer,” says Baez.

“We are also excited about our NEXT GEN wraps. We have developed some exciting flavors such as Hawaiian Bread flavored Wraps, Sourdough flavored Wraps, Cinnamon Flavored Wraps, Maple Syrup flavored Wraps, and Waffle flavored Wraps. The concept of these wraps is to ‘break traditions’ and help restaurant operators unleash their creative concepts using one of these flavored wraps,” says Baez. “For instance, with our waffle-flavored wrap, we give chefs the ability to create portable breakfast/lunch/dinner items based on a traditional chicken/waffle concept. And as we look at the other NEXT GEN wraps, it allows for the creation of some out of the box items that hopefully can help our partners create more foot traffic by featuring some new exciting concepts and generate additional revenue. This is all exciting and it supports growth for everyone.”

Consumers are looking for ways to mix things up. In July 2021, Old El Paso released Burrito Bowl Kits and Street Taco Kits, along with Cilantro Lime Rice. In October, they followed that with new Old El Paso hot chili pepper and lime-flavored taco shells, partnering with Takis Fuego to bring the new product to shelves.

In 2021, Mission released Fresh Signature Flatbreads, in Naan, Mini Naan, Flatbread, Pita, and Whole Wheat Pita varieties, and Gluten Free Tortillas in Cauliflower and Almond varieties. In August 2021, Crepini released grain-free Egg Wraps, with varieties ranging from Egg Wraps with Gluten Free Grains to Egg Wraps with Cauliflower.

In June 2021, B-Free expanded its product line with gluten-free avocado wraps, great for those with Celiac, and in October, ALDI launched keto tortillas.

Bessette says that the Tumaros brand of tortilla wraps leads in market share for wraps in the Northeast and is currently second overall nationally. “Tumaros leverage several health and wellness attributes including low-calorie, low-carb, no added sugar, Keto friendly, and are a good source of fiber. Coming this spring 2022, Tumaros will be launching two new items: an 8-inch version of our Everything Bagel Carb Wise wrap, as well as an 8-inch Classic Sourdough Carb Wise wrap.”

The everything bagel flavor is exploding across several categories and there is a lot of interest in this flavor profile, as it is highly versatile, Bessette notes. “Consumers are actively adding this spice blend into wrap recipes, presenting a great opportunity to align with our consumers’ flavor interest. As for sourdough, the traditional bread is making a resurgence driven by the increase in home baking during the pandemic. Consumers are cooking more meals at home and are looking for recipes with unique flavor profiles and trending ingredients to help bring their dishes to life and these new Tumaro’s products deliver on that,” Bessette adds.

“We’re also seeing greater demand for larger case size packages of tortillas and we’re planning to address that need with innovation coming later this year,” says Bessette. “From a foodservice perspective, we’ve recently reformulated our wraps to ensure they deliver on pliability and overall high performance for our foodservice customers.”