The Bottom Line:

- The category’s sales increased overall

- Private label products performed well

- Consumers are seeking bold, spicy flavors

America remains a nation of avid snackers. Who can blame us? Snacks are delicious, and snacking is just plain fun. Best of all, snacks—at least when wisely chosen—need be no less, and may be even more, healthful than going hungry. All things considered, it’s no surprise that sales of nutritional snacks, trail mixes, and snack nuts keep going strong.

Market data

How strong? Strong enough for both the snack nuts and nutritional-snacks/trail-mixes sectors to post-sales exceeding the billion-dollar mark for the 52 weeks ending April 23, 2023, according to Circana (Chicago) OmniMarket Integrated Fresh data.

Getting into the details, snack-nuts sales as a whole clocked in at $5.09 billion, reflecting a 1.4% decline over the previous year but still impressive nonetheless.

Private-label brands topped the snack-nuts field with sales of $1.91 billion and growth of 1.6%, but by no means did they dominate. Close behind, The Wonderful Company and Planters duked it out for second and third place, respectively, with the former bringing in $955.86 million on a 1.8% sales decline and the latter selling $911.9 million worth of snack nuts, albeit at a 6% decline relative to the year prior.

Performance elsewhere in the sector proved solid but not spectacular, with the main gainer being Peanut Patch, which saw sales rise 17.1% to $62.77 million. Meanwhile, the biggest drop—13.8%—went to Emerald Nuts, which nevertheless contributed $82.64 million to the snack nuts till for the year.

Source: Circana, Total U.S. Multi-Outlet w/ C-Store (Grocery, Drug, Mass Market, Convenience, Military, and Select Club & Dollar Retailers), 52 Weeks ending April 23, 2023

The state of play for nutritional snacks and trail mixes was even stronger, although the category’s market value overall trails snack nuts, with sales for the 52 weeks in question totaling $1.31 billion, 3.8% higher than the previous year’s.

Once again, private-label nutritional snacks and trail mixes led the pack, with sales hitting $731.24 million on impressive 7.9% growth. In distant second was Planters, whose sales of $71.29 million reflect a year-on-year decline of 4.4%. But third- and fourth-place brands Kar’s Nuts and Snak Club both enjoyed double-digit growth for the 52 weeks, with Kar’s sales rising 11.6% to $66.60 million and Snak Club’s climbing 16.5% to $41.36 million.

Perhaps surprisingly, last in the group was General Mills’ Chex Mix—arguably the original snack mix—with sales of $18.53 million on a decline of 5.7%.

Looking back

As for what’s driving sales of nutritional snacks, trail mixes, and snack nuts, it’s no surprise that healthy eating played a part. As Diana Salsa, associate vice president of marketing, Wonderful Pistachios, observes, consumers’ “return to a ‘new normal’” played a role in guiding their healthy choices.

Post-COVID, she says, “they’re paying more attention to what they put in their bodies, and one of the most prevalent trends that stood out to us over the past year has been consumers’ continued interest in living healthier lifestyles and making smarter snacking decisions.”

This bodes well for nuts in general and pistachios in particular, she claims. “As the highest-protein snack nut and a good source of fiber, our pistachios have had continued success with our marketing and communications focused on consumers seeking ‘better-for-you’ snacks,” Salsa says. “We’ve dedicated advertising campaigns to generating awareness about the health benefits of consuming pistachios, such as protein power and low sodium options.”

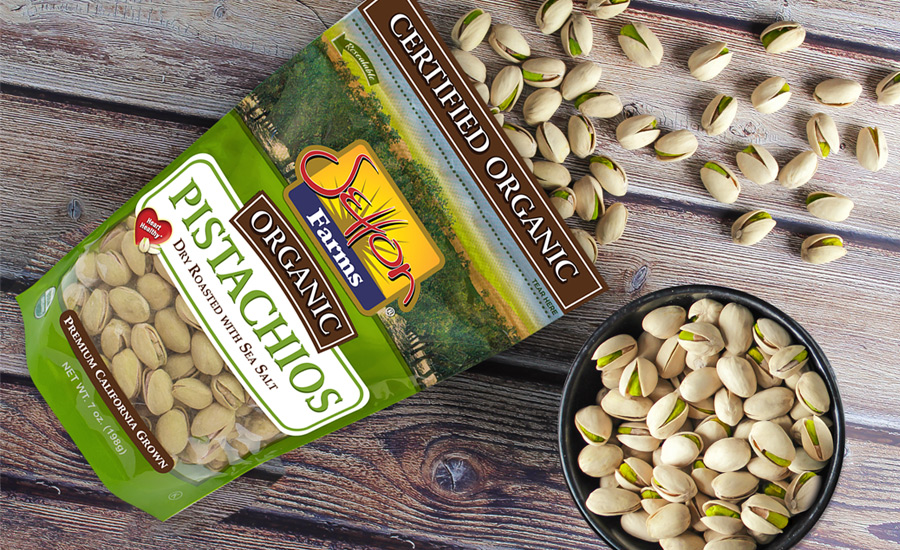

And those benefits stand on sound science, notes Joseph Setton, executive vice president, Setton Farms, who points to “two amazing nutritional-research papers” suggesting that pistachios may be “the next superfood.”

As he recounts, “Pistachios were found to be one of the few ready-to-eat complete proteins, which means they contain all nine essential amino acids the body needs but can’t produce itself. They also have antioxidant levels that rival cranberries, blueberries, and pomegranates.”

But to reiterate: Snacking, even the healthy kind, should be fun—and one-way brands are ensuring that is by introducing inventive flavors. Notes Setton, “We’ve seen significant consumer demand for bold and spicy flavors, but in a healthier way.” Their answer: Buffalo Wing and Scorpion Pepper pistachio kernels, which the company dry-roasts with natural seasonings “for a convenient and delicious snack.”

Salsa notes that The Wonderful Company has also driven incremental sales and “brought new buyers to the snack-nut category” via flavor innovation. “Based on our internal research, 55% of consumers would eat more nuts if they were flavored,” she contends, “so we’ve continued to expand our In-Shell and No Shells lineup with flavor offerings that’re both adventurous yet familiar.”

Cases in point, No Shells Chili Roasted and Honey Roasted varieties dropped in 2019, and in 2021 Wonderful added Sea Salt & Vinegar and Smoky Barbecue to their No Shells line to accompany the veteran Roasted & Salted and Lightly Salted options already there.

“This year alone, we’ve unveiled two new flavors,” Salsa continues, “including No Shells Sea Salt & Pepper, and most recently In-Shell Seasoned Salt.” The latter “adds zest to every snacking occasion with a blend of savory seasonings accented with garlic, onion, and paprika,” she says, and is the first addition to their In-Shell family in more than a decade, joining Salt & Pepper, Sweet Chili and classics like Roasted & Salted, Lightly Salted and No Salt.

Speaking of introductions that took more than a decade to cook, Michelle Nelson, senior brand experience planner, General Mills, is proud to announce that after ten-plus years of “calls, petitions, and social-media mentions,” Chex Mix returned “the iconic bagel chip” to Traditional Chex Mix bags earlier this year.

“The bagel chip rejoined Chex Mix’s original recipe,” Nelson elaborates, which comprises corn and wheat Chex, pretzels, rye chips, and mini breadsticks seasoned with a “unique blend for a one-of-a-kind snack that fans know and love.

And as further demonstration that what’s old is new again, the brand even partnered with—wait for it—Sir Mix-A-Lot, “the OG king of mixes,” per Nelson, to create a Chex Mix-inspired remix of “Baby Got Back.” Titled “Bagel is Back,” the tune is “an iconic remix for an iconic snack,” she declares.

Looking forward

But brands, like time, move onward, and The Wonderful Company’s forward march is taking it toward social media.

“We’ve enjoyed seeing creative pistachio-related trends across social media this year, from picture-worthy charcuterie boards to pistachio lattes,” Salsa enthuses, adding that the company has even “created some trends ourselves: We revived our Get Crackin’ campaign—which focuses on the joy of cracking open and eating pistachios—and brought it to TikTok for the first time.”

The company goosed the campaign’s virality by teaming with content creators like Thoren Bradley, Daniel and David Hulett, and Vanessa Amaro “to share how they Get Crackin’ with Wonderful Pistachios,” Salsa says. “We hope others will see their videos and be inspired to show us how they crack open creatively and enjoy Wonderful Pistachios, too. And we look forward to continuing the momentum as the year goes on and can’t wait to see what pistachio trend comes up next in the zeitgeist.”

Over at Setton Farms, future developments are taking the company back to the soil. “Consumers are more invested in where their food comes from and how it’s made,” Setton explains. “As a family-owned and –operated company, we can share our story and how we grow pistachios sustainably and regeneratively.” The upshot: “Consumers see the value in our pistachios not only because they’re nutrient dense but because our transparency encourages trust in the quality of our products.”

Moreover, as the appeal of organic nuts and snacks broadens, more consumers are making their organic purchases at traditional retailers than at specialty stores, Setton says, which suggests to him that “there’s a lot of opportunity for the mainstream organic market.”

Setton Farms is seizing that opportunity by opening a dedicated organic pistachio facility with capabilities for producing bulk, retail, in-shell, and kernel products. “Our organic pistachios hit all the marks consumers look for,” he says. “They’re USDA organic, grown with care, Non-GMO Project-verified, kosher, and certified gluten-free.”

Also, they make snacking the sensory delight consumers crave. “Pistachios stand out in a mix with their beautiful green color,” Setton argues, “and including them instantly adds value for the consumer. Our Premium Blend line highlights our family’s pistachio kernels and various dried fruits and nuts. It comes preloaded in attractive displays and offers a variety of sweet and savory flavors that consumers love.”

NEW SNACK MIXES & NUTS on snackandbakery.com

Daily Crunch sprouted nut snacks

Diamond Foods Harmony trail mixes

Sutter Foods Unbound Snacks walnuts

Discover More New Products at snackandbakery.com/newproducts