How to infuse healthier ingredients like whole grains and protein while maintaining the taste and texture that breakfast consumers want is a driving force in the frozen breakfast products market, consisting of core morning toaster options like pancakes, waffles and French toast.

“Five, 10 years ago, looking at the ingredient listings of frozen waffles or frozen pancakes wasn’t a top priority for anybody,” says Keith Seiz, ingredient marketing representative, National Honey Board, Longmont, CO. “You bought it, you put it in your toaster oven, you made the product, and it tasted good. Mirroring what’s going on everywhere else in food and beverage, that’s changing. People are wanting to know what’s in their product.”

Overview | Bread | Tortillas | Sweet Goods | Snack Cakes | Pizza | Desserts | Cookies | Buns & Rolls | Bars | Breakfast Products

Market data

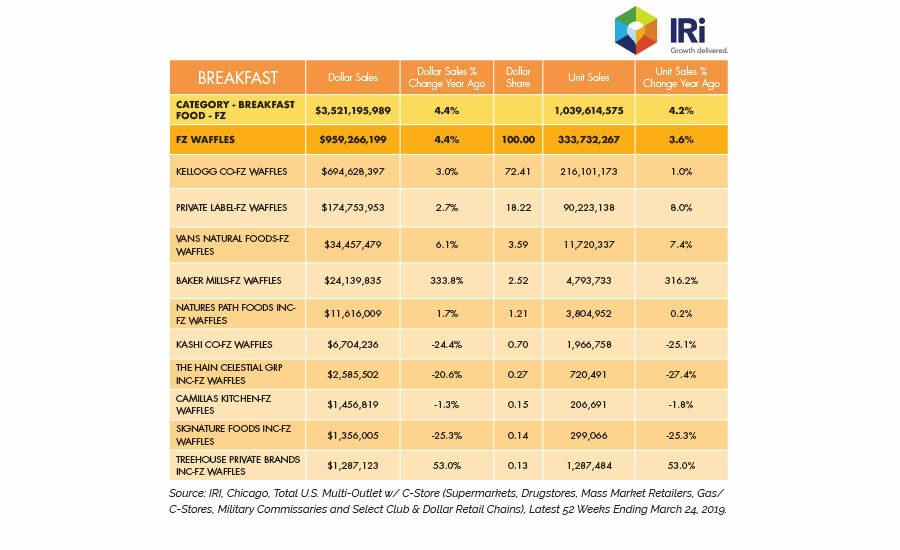

Sales in the overall frozen breakfast food category grew 4.4 percent to $3.5 billion for the 52 weeks ending March 25, 2019, per IRI, Chicago. The frozen waffles segment likewise rose 4.4 percent, reaching $959.3 million.

Kellogg’s Eggo brand dominates and drove company sales in the category to $694.6 million for the period, up 3.0 percent. The flagship Eggo brand rose 1.2 percent to $512.2 million, while its Thick & Fluffy frozen waffles sold another $84.6 million, up 41.9 percent.

Private label frozen waffles combined for $174.8 million in sales, up 2.7 percent. The next-highest company in the segment after Kellogg’s is Van’s, with $34.5 million in sales, up 6.1 percent.

But the fastest growing lines in frozen waffles are both under Kodiak Cakes from Baker Mills: Power Waffles saw $18.6 million in sales, up 321.9 percent, and Energy Waffles hit $5.6 million in sales, up 379.0 percent. Both brands take a nutrition-led approach.

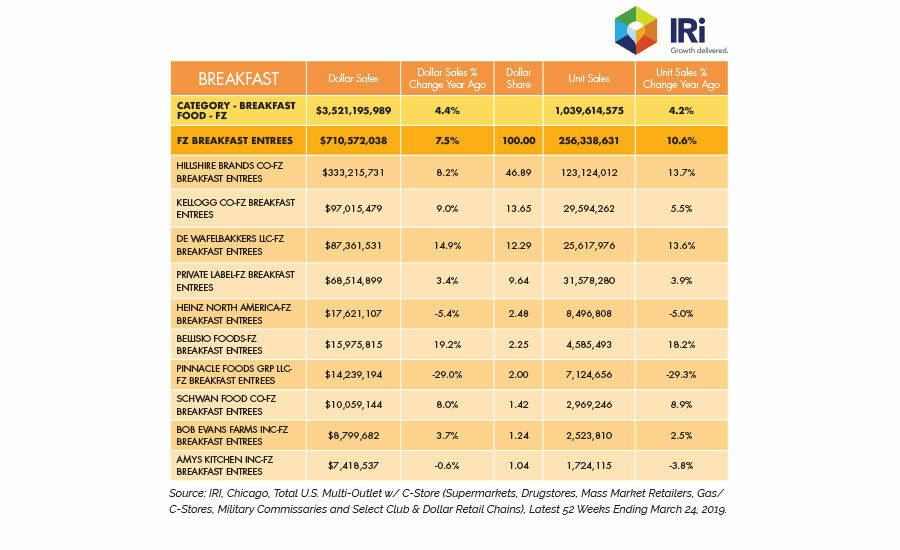

The frozen breakfast entrées segment, which includes frozen pancakes, rose 7.5 percent to $710.6 million for the 52 weeks ending April 25, according to IRI. De Wafelbakkers leads the segment and saw $87.4 million in sales, up 14.9 percent.

Looking back

The frozen waffle category needed a reinvigorating, suggests Joel Clark, co-founder and CEO, Kodiak Cakes, Park City, UT, which entered the category in late 2017. “We looked at it as a wide-open, tired, hibernating category that needed innovation. We went in with our angle, which is whole grains and protein, and that resonated quickly in the category. We are seeing more and more brands trying to get into healthier products.”

That hasn’t happened as quickly as it might have due to lack of capacity, Clark says. “Our competitors who saw us go into the space said they couldn’t find manufacturing capacity. That might have hindered more people from jumping into the category.”

Kodiak Cakes invested in its own equipment and bought manufacturing lines, while helping co-packers obtain more of their own. “That has been hard, working through that,” Clark says. “One of the reasons why is, it is a mature category. Most of the capacity was being used, but there wasn’t a lot of growth, so nobody was investing in more equipment.”

While nutrition is driving sales in the segment, ingredient thresholds can prove a limiting factor. “We’ve got 12 grams of protein in our waffle,” says Clark. “To go higher than that gets really tricky. You take a hit on texture and taste.”

The sudden spate of new frozen breakfast products featuring whole grains and high protein has been on the radar screen of Manildra Group, USA, Leawood, KS, says Brook Carson, vice president of product development & marketing. “It seems like everybody is releasing a new pancake product. Like a lot of other things in the baking industry, if you can get whole grain and high protein, and it still tastes good, there’s a lot of interest in that.” To that end, Manildra has been testing new clean-label proteins over the past year or so.

Another key dilemma, Carson says, has been finding the right texture for a product that contains healthier ingredients, will go through a freeze/thaw cycle, and then be prepared in different ways by different consumers. “We’ve been working on wheat proteins to improve the texture,” she says. “There’s a range of proteins that can give you a lighter, fluffier texture, or denser and chewier, or something in between. You want to dial in on something that’s unique.”

People are also seeking different sources of protein, notes Stephanie Lynch, vice president of sales, marketing and technology, International Dehydrated Foods (IDF), Springfield, MO. “They’re looking for all kinds of ways to get more protein and higher fiber into these categories.” To help fuel R&D inspiration, IDF has put together videos that illustrate how to add chicken protein to waffles and other products, like muffins. “People are trying to figure out how to make these products more nutritious overall, with fewer empty calories,” she says.

As frozen breakfast manufacturers look for ways to do so while still maintaining taste, they might follow the example of other bakery categories, such as bread and English muffins, which increasingly rely on honey as their sweetener of choice, suggests Seiz. “All these products need some type of sweetener system, especially as we see more whole grains being brought into the frozen waffle and pancake segment. The American palate doesn’t find whole grains acceptable without a sweetener.”

Looking forward

Going forward, Seiz believes that companies will opt to formulate with honey more often, given its consumer familiarity and comfort level. “Honey has been used in the baking industry for ages. It’s not like it’s a new ingredient that’s going to be a learning curve, or that you’re also going to add a masking agent to cover it up. Using honey for these manufacturers won’t be an issue.”

Honey has the ability to smooth out the rough edges that whole grains can introduce into a product, without the need for any sweet talk in the marketing materials, Seiz says. “Most of the time, you’re hiding the sweetener. Look at the bread aisle. You see ‘honey whole wheat’ loaf. You don’t see ‘sugar whole wheat’ loaf.”

To the extent frozen breakfast products are aimed at kids, broadcasting that they are sweetened with honey would be much more acceptable to mom and dad, Seiz asserts. “It’s just a little early. The category has been focused for the most part on price,” he says. But as whole grains become more prevalent in frozen breakfast products, the category will start to mirror the bread aisle, he suggests. “It wasn’t until whole grains and wheat became the norm and mainstay that honey became such a prominent part.”

Carson expects to see manufacturers branching out into different types of grains, such as buckwheat. “I’ve heard a lot of discussion about heirloom grains,” she says. “I don’t know how far it will go, but that will continue to grow. It will be interesting to see how it grows at scale because the input is, by definition, at a smaller scale.”

Similar to other flour-based categories, Clark predicts that alternative flours aimed at the paleo and keto trends will pop up in the frozen breakfast case. “We do see things in super-small brands,” he says. “We’ll start to see those a little bit in frozen.” But such upstarts might face the same challenges with capacity, he adds. “We learned just how hard the supply chain can be in this category.”

Nutrition-forward frozen breakfast foods will continue to make waves in the category—but they need to taste good, notes Clark. “We under-anticipated how hard that was going to be.”

Overview | Bread | Tortillas | Sweet Goods | Snack Cakes | Pizza | Desserts | Cookies | Buns & Rolls | Bars | Breakfast Products