For years now, China has been the "next big thing" when it comes to globalizing markets. I'll be the first to admit that it's true.

I lived in Shanghai for 13 years, spending my K-12 years at an American school there and I can tell you, Shanghai – and, by extension, China – is a place that can change in what feels like the blink of an eye.

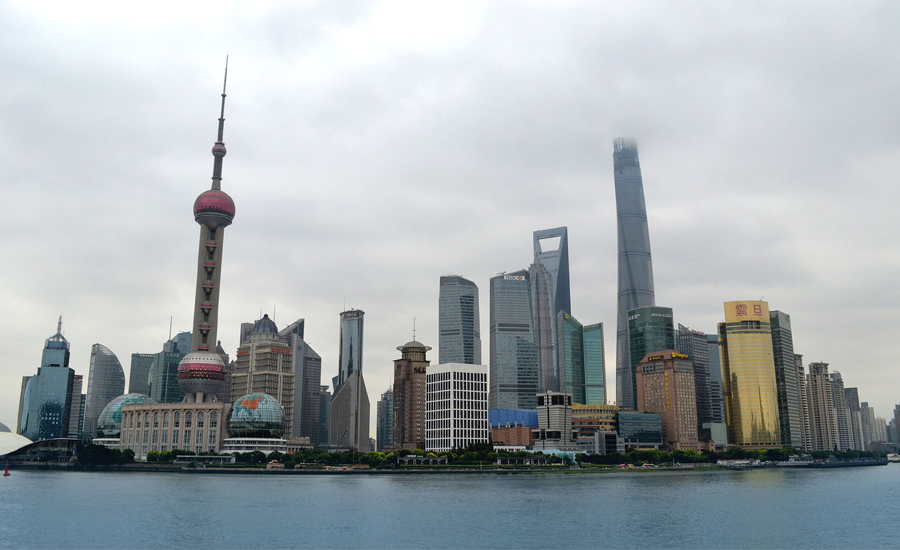

When I first moved to Shanghai in 1998, the eastern side of the city, Pudong, boasted one major skyscraper that dwarfed its surrounding buildings: the Pearl Tower. Now just 18 years later, that side of the city is so crowded with skyscrapers that their majesty is lost in competition with one another.

In just three months, Shanghai can put up giant malls, highways, hotels. Compare that to the relatively slow-changing Chicago, where I now live and where I've seen the same road under construction for close to two years.

I'm not saying Chicago is too slow – in many ways, I prefer it. But there's no arguing that China's relentless push to grow in almost every way has propelled its economy forward with astounding speed.

And it's true, the rate at which China's GDP is growing may not be sustainable. But when you have a country growing with such ferocity, a dip in the growth rate is hardly cause for concern.

A recent post by Euromonitor, citing its report "Packaged Food in China," says that China's annual real GDP growth dropped from 9-11 percent at the start of its 2010-2015 review period to eight percent in 2012, and finally to just under seven percent in 2015. But although the country's growth might be slowing down, real disposable income levels continue to rise, with a per capita growth of 7 percent in 2015.

Notably, China is seeing both rapid urbanization and strong retailing development. The country's urban population rose from 47 percent in 2009 to almost 54 percent in 2014. The number of supermarkets and hypermarkets in the country also increased by seven percent CAGR and 12 percent CAGR respectively between 2010 and 2015.

All of this is a boon for the packaged food industry.

Urban consumers living in close proximity to supermarkets have access to a considerably wider range of packaged food options, have noticeably higher income levels than rural consumers, and typically have fast-paced lifestyles due to long working hours and commutes, says Euromonitor.

These factors all combine to drive sales and growth by encouraging consumers to turn to packaged food both for convenience and to mitigate food safety concerns.

Not only that, but the rapid increase in the number of internet and smartphone users will also drive internet retailing, making it easier for consumers to get their hands on packaged food.

Supermarkets and hypermarkets are still the leading distribution channels, benefiting from ongoing outlet volume expansion and urbanization and outperforming independent small grocers. But it's only a matter of time in a country that's home to online retail giants like Alibaba.

So although growth in packaged food, like growth in the overall Chinese economy, is likely to soften, it'll still remain strong. With total disposable income levels in China expected to rise almost 6 percent over 2013-2030, there are plenty of opportunities for the country's growing mid-income group to expand and drive private consumption.

China is a veritable giant in its economy and so much more. Shanghai is its largest city, with an almost-unfathomable population of more than 24 million. Even second-tier cities in China can dwarf the population of Chicago.

The country has spent the last few decades reinventing itself and becoming a force to be reckoned with on the global stage. It caught everyone's attention with its incredible growth while the United States was reeling from the Great Recession.

Now, in spite of slowing growth rates, is not the time to write China off. If anything, it's time to pay closer attention.