Over the past year, the market for chips has seen positive gains as product selection grows continually more diversified, with tactics related to better-for-you and intriguing flavors both driving sales. Meanwhile, chip producers look toward new ingredients, like diverse grains—including ancient grains—and innovative processing techniques to improve chip quality.

According to IRI, Chicago, potato chips gained 2.13 percent in dollar sales for the 52 weeks ending Oct. 4, 2015. Cape Cod chips, a Snyder’s-Lance brand, performed well, up 19.06 percent for the 52-week period. Relatively new additions from the company include the Waffle Cut and Limited Batch lines, with the latter including flavor-forward varieties like Sweet Red Chili and Chipotle Barbeque.

Kettle Brand chips also saw nice gains for the period, up 10.65 percent in dollar sales. (For more on Kettle Brand, see “Natural chip leader Kettle Brand continues innovation” in the November 2015 issue of Snack Food & Wholesale Bakery.)

Corn snacks saw a gain, up 3.43 percent in dollar sales for the period. A notable performance came in from Frito-Lay’s Fritos Flavor Twists, with a 45.17 percent gain in dollar sales. Frito-Lay is far and away the segment leader, with 75.99 percent dollar share.

But the most-significant sales leaps came from fruit and vegetable chips. The apple chips segment overall grew by 27.26 percent in dollar sales for the 52 weeks ending Oct. 4, clearly indicating that shoppers have developed an affinity for the better-for-you snack variant. A standout in this segment is Pine Creek, owner of the Bare Fruit brand, which saw a leap of 214.85 percent dollar sales for the year. In addition to apple chips, the brand offers Bare Coconut Chips and Bare Banana Chips.

Kettle Brand, meanwhile, is in the process of launching a new line of vegetable chips known as Kettle Brand Uprooted.

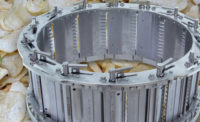

Fried to perfection

While baking chips has grown more common over the past decade, many types of chips still rely on frying. “Chip manufactures have numerous opportunities to improve their overall frying systems,” says Chris Abrams, product director, Dalsorb, The Dallas Group of America Inc., Whitehouse, NJ. “First, they should start with selection of a quality, high-stability, frying oil and make sure to receive a certificate of authenticity (COA) with every load received. Second, it is crucial to maintain frying equipment on a regular basis, with emphasis placed on temperature controls, heating and heat-transfer surfaces. Third, producers should ensure they have in place a comprehensive sanitation process that keeps all food contact points clean and free of buildup. Finally, they should limit frying oil contact with heat, air and water, since all three contribute to oil degradation.”

And then there’s the oil itself. A quality chip begins with a quality oil—but it’s not always that cut-and-dried. “If a chip producer is handling and maintaining their frying oils with best practices, but still has difficulty with oil quality, they definitely should be utilizing a Dalsorb treatment process,” says Abrams. The process removes contaminants from the frying oil, helping operators produce chips within their product and oil quality standards.

“This improves product shelf life and taste,” says Abrams. It also saves money. “It eliminates the need to discard frying oil for high contaminant levels, off-flavor or dark color,” he says.

The additive chemically bonds to contaminants formed while frying. “It essentially acts as a ‘magnet’ that bonds to free fatty acids, polar materials, colors and off-flavors,” says Abrams. “Keeping contaminants to a minimum allows the end user to utilize nearly 100 percent of their frying oil to produce crisp, quality chips.”

Going with the grain

“The snack category, and in particular multigrain chips, is ripe for innovation on the grain front,” says Don Trouba, director, marketing, Ardent Mills, Denver. Manufacturers have begun working with ancient grains, both flour and whole seeds, to add appeal and texture to chips. He cites sprouted grains as newer territory. “It has great flavor,” he says, noting that current supply can support national product launches.

White whole-wheat builds widespread appeal into chips, along with seamless nutrition gains. “Ultragrain whole-wheat flour continues to gain traction in this segment,” says Trouba. “It has had success at retail, but has become the go-to ingredient for companies making snacks for the K-12 school foodservice segment.”

Trouba notes that some ingredients can multitask to add value to better-for-you chips: “Sustagrain, our ultra-high-fiber whole grain with three times the fiber of oats, is the perfect choice for boosting fiber naturally in snacks,” he says. “Available as flour and flakes, high in beta-glucan, and with a mild flavor, it can add fiber to smaller portions, all while being cleanly labeled as ‘barley.’”

Better-for-you chips don’t need to compromise on flavor. “The key to better-for-you chips is to focus on selecting whole grains that can deliver taste and marketing appeal,” says Trouba. “Developers need to know that it’s possible to select whole grains without compromising taste if they want a broad, mainstream application.”

Improvements behind the scenes

Select shopper demographics continually dig deeper into the farm-to-table dynamics related to their foods—and this now includes processing. As the concept of “clean label” continues to mature, manufacturers have the ability to refine chip manufacturing to emerge on the cutting edge of better-for-you snacking.

Acrylamide generally isn’t the first subject that comes to mind when discussing clean label, but the industry has taken steps toward reducing levels in fried chips. “According to the recent European Food Safety Authority report on acrylamide, potato products are the No. 1 dietary source of acrylamide, constituting approximately 25–50 percent of the daily acrylamide exposure for both children and adults,” says Matthew Dahabieh, Ph.D., president, Renaissance Ingredients Inc., Vancouver, British Columbia.

Dahabieh notes that using an acrylamide-reducing yeast as part of processing can significantly reduce levels found in finished products. “Our successful laboratory-scale testing of the acrylamide-reducing yeast in potato products gives us confidence that we can soon attain consistent reduction levels of up to 95 percent by working closely with the food industry in pilot-scale testing and process refinement,” he says.

Manufacturers that implement reduction processes can label their foods as “acrylamide-reduced,” if desired, notes Dahabieh. “However, there is no mandate to do this—except in California,” he adds. In California, Proposition 65 requires manufacturers to mark foods that contain any carcinogens noted in the proposition with a warning label, so a label distinction in that market could prove advantageous.

“Consumers are willing to pay for things they find value in, especially when it comes to food and health,” says Dahabieh. “The rise in popularity of organic, free-range and non-GMO foods is a prime example of this.” He notes that a recent study found that consumers were willing to pay more for acrylamide-reduced potato products (“New research from Iowa State University economist finds consumers willing to spend more for biotech potato products,” March 10, 2015, Iowa State University News Service). “However, we believe that our solution—the acrylamide-reducing yeast—will have only a minor impact on product prices at the grocery store, and therefore there are few financial obstacles preventing food manufacturers from using our AR yeast.”

In a snack segment that continually grows more competitive, producers will look for any range of tactics to gain an edge.