Predictively meeting consumer needs and desires forms the mantra for so much of the bakery industry today. This means understanding that some classic, tried-and-true products should stay just that—classic, tried-and-true, unchanged in the face of today’s prevailing and emergent trends. Meanwhile, other product areas—including reformulation projects and new product development—require a judicious hand in establishing target shopper demographics and associated core product characteristics.

Overview | Bread | Tortillas | Sweet Goods | Snack Cakes | Pizza | Desserts | Cookies | Buns & Rolls | Bars

Looking back

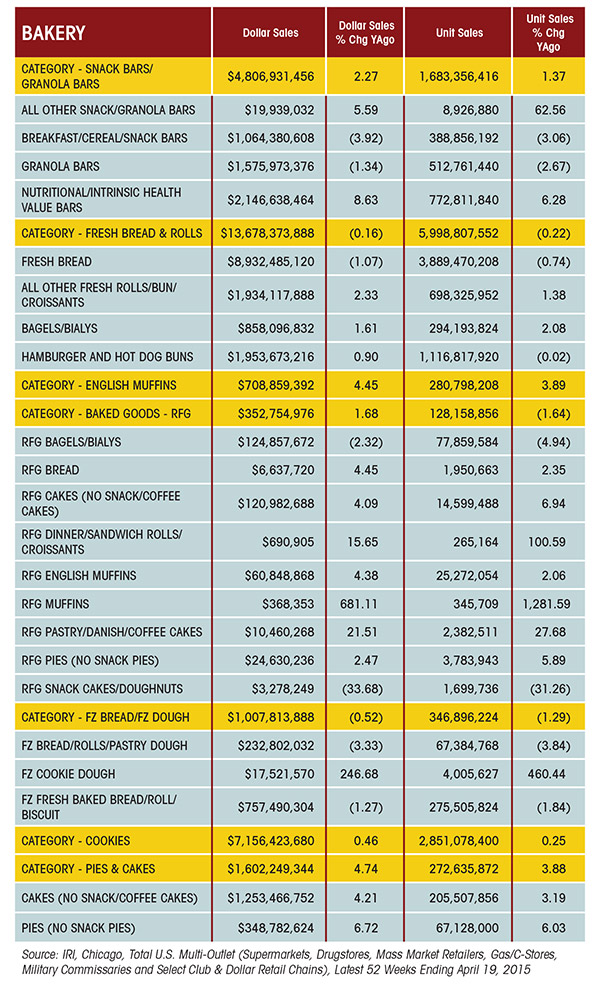

We continued to see strong brand dominance in the top five companies and brands across many bakery categories, according to data provided by IRI, Chicago. Elsewhere, multiple trends continued to shape the state of the bakery industry over the past year—including better-for-you, gluten-free and flavor diversity—all of which will progressively mature over the next year and beyond, impacting every category in bakery in at least one shape or form and capturing more dollar share.

A top trend seen across nearly every segment of bakery, in varying degrees, remains better-for-you. To some consumers, better-for-you means a clean label, non-GMO, fresh, natural and organic. To others, it’s smaller portion sizes and calorie control. And still to other demographics, it’s lower sodium and fat, fewer calories and more of the good stuff we need, like whole and diverse grains, fiber, nuts, seeds and fruit.

According to Chicago-based Mintel’s September 2014 “Bread and Bread Products—U.S,” consumers demand better-for-you foods in myriad ways, including relative claims like “less processed” and “fresher,” as well as through verifiable tactics like fortification with fiber, vitamins and minerals. To that end, bakeries have added traits like whole-grain, low/no/reduced fat and no additives/preservatives to products. The report notes some 37 percent of respondents who buy bread cite “high fiber” as a reason for selecting one bread type over another, and more than two in 10 say added nutrients, such as calcium or protein, determine selection.

Aside from kosher, statements related to low/no/reduced trans fat and no additives and/or preservatives are leading all product claims. As FDA prepares to institute a ban on partially hydrogenated oils (PHOs), expect to see claims related to trans fat content intensify.

Claims for whole-grain and low/no/reduced cholesterol closely followed. Mintel also notes that one-third of respondents who buy bread report that an “all-natural (no additives or preservatives)” claim prompts them to select one type of bread versus another. About 45 percent of respondents who purchased more bread in the last six months cited a desire to eat more healthfully as the reason for their selections.

New product flavor and format diversity continues to entice, including nontraditional and ethnic breads (for a complete overview of new products aligning with today's bakery trends, handpicked by Mintel for this article, see "State of the Industry, Bakery: New Products"). Mintel notes that this trend is reflected in the more than two in 10 respondents who bought more bread in the last six months because they are eating more ethnic meals. Also, more respondents who buy bread say they are buying “more rather than less” ethnic and international bread types like:

- Tortillas and flatbreads

- Italian breads

- Middle Eastern breads, such as lavash

- Egg-based breads, such as challah

- Indian breads

Consumers are also generally looking for new flavors of traditional breads. Mintel notes that one-third of respondents who buy bread say flavor factors into their selection of one bread type over another, and nearly three in 10 say a wide range of appealing flavors motivated them to buy the breads they bought most often in the last six months. Also, more than four in 10 respondents say they select the bread they buy most often because they are eating more sandwiches.

Sales data for bagels and English muffins, two segments that trended positively over the past year per IRI, up 1.61 percent and 4.45 percent in dollar sales, respectively, shows ingredient and flavor diversity translating into higher sales, with ingredients like various seeds, ancient grains, dried fruit inclusions and sprouted grains—sometimes along with gluten-free—in the mix.

Better-for-you product introductions over the past year have included baked goods like:

- Oatmeal whole-grain bread

- 100 percent whole-wheat miniature ?bagels

- Low-carb wraps made with flax seeds and oats

- Flourless sprouted whole-grain ?English muffins

- All-natural, whole-grain hamburger buns free from gluten, soy and dairy

- Organic multigrain artisan-style rolls that are lactose-free and kosher

According to Mintel’s September 2013 “Gluten-free Foods—U.S.” report, gluten-free claims increased dramatically from 2009–14, up 200 percent, primarily due to the perceived association between gluten-free and health in people without celiac disease. About two-thirds of Americans who eat gluten-free foods for reasons other than intolerance or sensitivity (65 percent) do so because they believe the foods are healthier, while 27 percent go gluten-free for weight loss.

Many newer gluten-free products have begun to align with an emerging “free-from” category, with products also going allergen-free and GMO-free.

The resonance of such claims can prove application-specific. Despite strong growth in the percentage of prepared cakes and pies with a gluten-free claim, the importance of gluten-free is secondary to other claims, such as reduced fat, sugar or calories, according to Mintel’s June 2014 “Prepared Cakes and Pies—U.S.” report. Some 10 percent of those who eat cakes and pies report that they look for allergen-free products.

Recent gluten-free—and often free-from—new products include:

- Gluten-free mini brownies that are also dairy-free and kosher-certified

- Chocolate chip cookie dough cupcakes that are free from gluten, dairy, soy, rice, egg, corn and potato

- An all-natural chocolate brownie that’s free from wheat, gluten, GMOs and trans fats

Format also plays a role in influencing the purchase of prepared cakes and/or pies. Mintel notes more than one-quarter of consumers (28 percent) indicate that availability of individual portion sizes, such as cake or pie slices, would influence them to purchase these items more often, while 20 percent would buy more prepared cake and pie products if miniature versions were available. Only 14 percent of consumers who eat prepared cakes and pies indicate they eat these items while on the go. Recently released products that can increase eating occasions for dessert products include miniature pie bites and upscale mini Bundt cakes designed to split between two people, as well as mini bar cookie versions of popular cheesecake styles.

Little continues to make a big impact. New miniature-sized baked goods concepts include:

- Miniature carrot cupcakes with cream cheese frosting and walnuts

- Apple cinnamon pie bites that cook in a conventional oven, toaster oven or ?microwave

- Chocolate cream brownie bites with a cookie crumb crust that cook in a conventional oven, toaster oven or home fryer

- German Stollen bites made with marzipan

- Lemon cake bites

Dubbing products as “gourmet” or “premium”—with the ingredients and flavor profiles to back up these claims—can entice shoppers. Mintel notes some 61 percent of survey respondents who eat prepared cakes and pies agree that gourmet or premium products are worth paying more for. Other on-target product descriptors include “decadent” or “luxurious.”

Seasonal items can also drive sales. Mintel notes “seasonal” product claims increased 280 percent from 2009–14. A survey showed some 22 percent of consumers indicate seasonal or limited-time-offer (LTO) status would influence them to purchase cake and/or pie products more often.

Seasonal and LTO items have proven intriguing, with pumpkin always a fall favorite, as seen in these recent items:

- Pumpkin spice bagels made with real pumpkin, spice and cinnamon

- Individually wrapped brownies in pumpkin shapes with an orange-frosted pumpkin face

- Caramel-pumpkin-pecan upside-down cake, which consists of a cinnamon-spiced pumpkin buttermilk cake topped with caramel and a pecan glaze

In the wake of the popular croissant-doughnut (and trademarked) Cronut portmanteau/hybrid—alternately called a “dossant,” “doughssant” or simply croissant doughnut—cross-pollination of ideas and product formats from one bakery category to the next continues. Other hybrids include the doughnut-biscuit (doughscuit) and waffle-doughnut (wonut). Crispy, cookie-like brownies and ultra-crisp, cracker-like cookies have also surfaced on the market.

Flavors also migrate across categories, such as applying a red velvet cake flavor to brownies or a rocky road ice cream flavor to chocolate Bundt cake. Manufacturers have also started using Greek yogurt in cakes over the past year or so. Savory flavors more akin to meat snacks or nut mixes, like hickory smoked and roasted jalapeño, have begun appearing in snack and ?nutritional bars.

Looking forward

According to Mintel’s April 2015 “American Lifestyles 2015: The Connected Consumer—Seeking Validation from the Online Collective” report, snacking continues to fit into American lifestyles. Snacking categories predicted to continue growth include traditionally indulgent products like cookies.

In its “Prepared Cakes and Pies—U.S.” report, Mintel reports that prepared cakes and pies, including snack sizes, grew 24 percent from 2009–14. Looking forward, the firm predicts the segment will grow an additional 18 percent from 2014–19, reaching sales of $13.2 billion, as bakers strive to meet demands for higher-quality ingredients, flavor-forward ?formulations and portability, including controlled portion sizes.

The retail pizza market faces an uphill battle, and Mintel forecasts flat sales for the U.S. market for store-bought pizza between 2014 and 2019. According to the firm’s June 2014 “Pizza—U.S.” report, frozen pizza brands face mounting competition from pizzerias restaurants, as more consumers are able to spend on restaurant pizza again, and a majority of consumers perceive store-bought pizza as inferior. More than six in 10 respondents report eating takeout or delivery pizza in the last six months, compared to the less than six in 10 who report eating frozen pizza during that time frame.

The firm suggests frozen brands can compete by continuing to focus on convenience, while also making quality improvements that are clearly highlighted on product packaging. Retail brands can close the quality gap between retail and foodservice pizza by focusing on premium ingredients, new flavor varieties, and higher-quality and interesting crusts.

IRI data shows largely flat activity in bread categories—but select companies and brands continue to show gains, including portion-controlled/calorie-controlled products. In its “Bread and Bread Products—U.S.” report, Mintel predicts a slow rate of growth into 2019, when sales are projected to reach $27 billion.

Capturing sales and category share will likely involve offering just the right mix of products. Nearly three in 10 buyers say they are eating less bread because it is too high in carbohydrates and calories, and 19 percent cite high sugar content. Better-for-you products like whole-grain and “light” could very well appeal to such consumers. The Mintel report specifically cites low-carb, low-calorie and high-fiber products as likely to help drive sales.

But the report also found that some buyers find the flavors of better-for-you products undesirable, suggesting that some products could benefit from more flavor innovation. It also cited “staleness too soon after opening” as a complaint about bread, perhaps pointing to an opportunity for improved packaging options to help preserve freshness, or simply offering products in smaller packages.

Increasingly, bakers look to gluten-free to diversify sales revenue streams. According to Mintel’s “Gluten-Free Foods—U.S.,” the gluten-free market reached sales of $8.8 billion in 2014, representing an increase of 63 percent from 2012–14, and that trend will likely continue. Mintel predicts gluten-free will grow an additional 62 percent from 2014–17, to reach sales of $14.2 billion in 2017.

Small to midsize companies will continue to take a flexible, leading edge in formulation styles and tactics, appealing to early trend adopters and helping set the pace of innovation. For larger, diversified bakeries, understanding your core consumers and selectively providing classic bakery products—along with a targeted mix of new options aligned with strong category trends—will help ensure that offerings appeal to the widest cross section of shoppers today.

You can have your cake and eat it, too. You just need to know when that cake should be formulated with an immaculate ingredient statement, smaller portion size and Ecuadorian Arriba cocoa—and when it should simply transport the eater back to childhood days long past, but never forgotten.

Overview | Bread | Tortillas | Sweet Goods | Snack Cakes | Pizza | Desserts | Cookies | Buns & Rolls | Bars